Sending Money

Who can I send money to?

We trade in nearly 100 currencies so you can send money to over 130 countries. Use the Xe Currency Converter to get the mid-market rate for your currency pair of choice or receive our send rate when sending your money.

Here's a list of our supported currencies (subject to change). Contact us if you don't see the one you're looking for and we'll try to help you arrange your transfer.

Albanian lek (ALL)

Algerian dinar (DZD)

Argentine peso (ARS)

Armenian dram (AMD)

Australian dollar (AUD)

Azerbaijani manat (AZN)

Bahamian dollar (BSD)

Bahraini dinar (BHD)

Bangladeshi taka (BDT)

Barbadian dollar (BBD

Bhutanese ngultrum (BTN)

Bolivian boliviano (BOB)

Bosnia and Herzegovina convertible mark (BAM)

Botswana pula (BWP)

Brunei dollar (BND)

Bulgarian lev (BGN)

Canadian dollar (CAD)

Cape Verdean escudo (CVE)

Chilean peso (CLP)

Colombian peso (COP)

CFP franc (XPF)

Costa Rican colón (CRC)

Croatian kuna (HRK)

Czech koruna (CZK)

Danish krone (DKK)

Djiboutian franc (DJF)

Dominican peso (DOP)

Eastern Caribbean dollar (XCD)

Euro (EUR)

Fijan dollar (FJD)

Gambian dalasi (GMD)

Georgian lari (GEL)

Ghanaian cedi (GHS)

Guatemalan quetzal (GTQ)

Guinean franc (GNF)

Honduran lempira (HNL)

Hong Kong dollar (HKD)

Hungarian forint (HUF)

Indian rupee (INR)

Indonesian rupiah (IDR)

Israeli new shekel (ILS)

Jamaican dollar (JMD)

Japanese yen (JPY)

Jordanian dollar (JOD)

Kazakhstani tenge (KZT)

Kenyan shilling (KES)

South, South Korean won (KRW)

Kuwaiti dinar (KWD)

Lesotho loti (LSL)

Malagasy ariary (MGA)

Malawian kwacha (MWK)

Malaysian ringgit (MYR)

Mauritian rupee (MUR)

Mexican peso (MXN)

Moroccan dirham (MAD)

Mozambican metical (MZN)

Namibian dollar (NAD)

Nepalese rupee (NPR)

New Zealand dollar (NZD)

Macedonian denar (MKD)

Norwegian krone (NOK)

Omani rial (OMR)

Pakistani rupee (PKR)

Papua New Guinean kina (PGK)

Paraguayan guaraní (PYG)

Peruvian sol (PEN)

Philippine peso (PHP)

Polish złoty (PLN)

Qatari riyal (QAR)

Romanian leu (RON)

Russian ruble (RUB)

Rwandan franc (RWF)

Samoan tālā (WST)

Serbian dinar (RSD)

Singapore dollar (SGD)

Solomon Islands dollar (SBD)

South African rand (ZAR)

Sri Lankan rupee (LKR)

Surinamese dollar (SRD)

Swedish krona (SEK)

Swiss franc (CHF)

New Taiwan dollar (TWD)

Tajikistani somoni (TJS)

Tanzanian shilling (TZS)

Thai baht (THB)

Tongan paʻanga (TOP)

Trinidad and Tobago dollar (TTD)

Tunisian dinar (TND)

Turkish lira (TRY)

Ugandan shilling (UGX)

United Arab Emirates dirham (AED)

British pound (GBP)

United States dollar, USD

Uruguayan peso, UYU

Vanuatu vatu (VUV)

Vietnamese đồng (VND)

We a provide safe, secure and fast money transfer service to countries all over the world. Your location will determine exactly which options are available to you.

The following countries are available for the majority of people (subject to change). If you don’t see your country listed, contact us and we’ll see if we can help you send your money.

Albania, Albanian lek (ALL)

Algeria, Algerian dinar (DZD)

Anguilla, Eastern Caribbean dollar (XCD)

Antigua, Eastern Caribbean dollar (XCD)

Argentina, Argentine peso (ARS)

Armenia, Armenian dram (AMD)

Australia, Australian dollar (AUD)

Austria, Euro (EUR)

Azerbaijan, Azerbaijani manat (AZN)

Bahamas, The, Bahamian dollar (BSD)

Bahrain, Bahraini dinar (BHD)

Bangladesh, Bangladeshi taka (BDT)

Barbados, Barbadian dollar (BBD)

Barbuda, Eastern Caribbean dollar (XCD)

Bhutan, Bhutanese ngultrum (BTN)

Bolivia, Bolivian boliviano (BOB)

Bosnia and Herzegovina, Bosnia and Herzegovina convertible mark (BAM)

Botswana, Botswana pula (BWP)

Brunei, Brunei dollar (BND)

Bulgaria, Bulgarian lev (BGN)

Canada, Canadian dollar (CAD)

Cape Verde, Cape Verdean escudo (CVE)

Chile, Chilean peso (CLP)

Colombia, Colombian peso (COP)

Costa Rica, Costa Rican colón (CRC)

Croatia, Croatian kuna (HRK)

Cyprus, Euro (EUR)

Czech Republic, Czech koruna (CZK)

Denmark, Danish krone (DKK)

Djibouti, Djiboutian franc (DJF)

Dominican Republic, Dominican peso (DOP)

Estonia, Euro (EUR)

Fiji, Fijan dollar (FJD)

Finland, Euro (EUR)

France, EUR (EUR)

French Polynesia, CFP franc (XPF)

Gambia, The, Gambian dalasi (GMD)

Georgian, Georgian lari (GEL)

Germany, Euro (EUR)

Ghana, Ghanaian cedi (GHS)

Guatemala, Guatemalan quetzal (GTQ)

Guinea, Guinean franc (GNF)

Honduras, Honduran lempira (HNL)

Hong Kong, Hong Kong dollar (HKD)

Hungary, Hungarian forint (HUF)

India, Indian rupee (INR)

Indonesia, Indonesian rupiah (IDR)

Ireland, Euro (EUR)

Italy, Euro (EUR)

Israel, Israeli new shekel (ILS)

Jamaica, Jamaican dollar (JMD)

Japan, Japanese yen (JPY)

Jordan, Jordanian dollar (JOD)

Kazakhstan, Kazakhstani tenge (KZT)

Kenya, Kenyan shilling (KES)

Korea, South, South Korean won (KRW)

Kuwait, Kuwaiti dinar (KWD)

Latvia, Euro (EUR)

Lesotho, Lesotho loti (LSL)

Lithuania, Euro (EUR)

Luxembourg, Euro (EUR)

Madagascar, Malagasy ariary (MGA)

Malawi, Malawian kwacha (MWK)

Malaysia, Malaysian ringgit (MYR)

Malta, Euro (EUR)

Mauritius, Mauritian rupee (MUR)

Mexico, Mexican peso (MXN)

Morocco, Moroccan dirham (MAD)

Mozambique, Mozambican metical (MZN)

Namibia, Namibian dollar (NAD)

Nepal, Nepalese rupee (NPR)

Netherlands, Euro (EUR)

New Zealand, New Zealand dollar (NZD)

North Macedonia, Macedonian denar (MKD)

Norway, Norwegian krone (NOK)

Oman, Omani rial (OMR)

Pakistan, Pakistani rupee (PKR)

Papua New Guinea, Papua New Guinean kina (PGK)

Paraguay, Paraguayan guaraní (PYG)

Peru, Peruvian sol (PEN)

Philippines, The, Philippine peso (PHP)

Poland, Polish złoty (PLN)

Portugal, Euro (EUR)

Qatar, Qatari riyal (QAR)

Romania, Romanian leu (RON)

Russia, Russian ruble (RUB)

Rwanda, Rwandan franc (RWF)

Samoa, Samoan tālā (WST)

Serbia, Serbian dinar (RSD)

Singapore, Singapore dollar (SGD)

Slovakia, Euro (EUR)

Slovenia, Euro (EUR)

Solomon Islands, Solomon Islands dollar (SBD)

South Africa, South African rand (ZAR)

Spain, Euro (EUR)

Sri Lanka, Sri Lankan rupee (LKR)

Suriname, Surinamese dollar (SRD)

Sweden, Swedish krona (SEK)

Switzerland, Swiss franc (CHF)

Taiwan, New Taiwan dollar (TWD)

Tajikistani, Tajikistani somoni (TJS)

Tanzania, Tanzanian shilling (TZS)

Thailand, Thai baht (THB)

Tonga, Tongan paʻanga (TOP)

Trinidad and Tobago, Trinidad and Tobago dollar (TTD)

Tunisia, Tunisian dinar (TND)

Turkey, Turkish lira (TRY)

Uganda, Ugandan shilling (UGX)

United Arab Emirates, United Arab Emirates dirham (AED)

United Kingdom, British pound (GBP)

United States, United States dollar, USD

Uruguay, Uruguayan peso, UYU

Vanuatu, Vanuatu vatu (VUV)

Vietnam, Vietnamese đồng (VND)

How long does it take?

When you confirm your money transfer, you'll see the expected date it will arrive with your recipient. You can also track your transfer in the app. Go to Track. If your money is delayed more than 24 hours beyond the expected date and you’re concerned, contact us.

It’s important to us that your money arrives on time and that you know where it is throughout, which is why you can easily track your money in the new app and online.

Here are some things that may slow the progress of your money transfer.

Transfer time

We let you know as soon as we transfer the money to your recipient’s bank, who then credit it to the recipient’s account. Sometimes, this takes up to 3 or 4 days. If you’re concerned it’s taking longer than the estimated payment date, contact us and we can ask the recipient’s bank to confirm.

Payment method

When we receive your money, we settle your contract and send it on to your recipient. When you pay by card, that takes just minutes. When you pay by bank transfer, Direct Debit, ACH or similar - it depends how quickly you arrange it and if there are any delays in your bank depositing the money in our account.

More information required

Sometimes we need to make additional security checks and that can slow things down. Check your emails for any requests from us for further information. We may ask for proof of ID, source of funds or the legal documentation for changes to details. You can upload copies of these in the new app.

Local business hours

Some currencies are available to transfer 7 days a week (subject to change) and others currently only available during local business hours. That means it may take longer for a currency to arrive if you send money near the end of a business day or at the weekend.

Non-domestic accounts

Sending money to an account where the currency is not the national currency of that bank may take longer e.g. sending USD to a USD bank account in China.

Once you’ve sent your transfer, you’ll want to follow its progress. We’ll send you a confirmation after you’ve started your transfer and once we’ve sent it.

If you want more information on your transfer status, you can easily track it online or in the app. Go to Track and you can see what's happening with all your money transfers.

Rates and fees

Some money transfers are subject to a small fee. Adding this send fee helps keep our send rates competitive. We’ll tell you if your money transfer is subject to a small fee before you send it.

The send rate represents the rate of exchange you will receive when sending your money with Xe using our transfer service. When using our free information services, such as the currency converter, you’ll see the mid-market rate.

The mid-market rate is the mid-point between the rate a currency can be bought or sold at. These rates are not available to customers - not even Xe can buy currency at this rate.

These rates are real time and are updated every 60 seconds during trading hours.

Our free information services always list the mid-market rate because it indicates the value of a currency that’s not weighted towards buying or selling.

The send rate represents the rate of exchange you will receive when sending your money with Xe.

We will send the exact amount you ask us to and we don’t apply or withhold any taxes on the money you send. In some cases, you or the person receiving the money may be required by law to pay tax on that transfer.

It’s your responsibility to declare and pay any taxes on the money you send. Contact your tax authority or speak with a financial advisor if you have any concerns about taxes.

Yes, you can set up something called a forward contract. You choose the current rate, which is always calculated at the mid-market rate, and set a date to send the money. Contact us and we'll help you organise that.

When would a forward contract be the right move for me?

Forward contracts are a great option if you’re worried about potential fluctuations in your currency pairs. Sure, you could just wait until you’re ready to make your payment or purchase to make your transfer, but you can’t guarantee that you’ll like your rate when the time comes.

Are you planning on making any larger purchases, particularly property or investments? You can ensure you'll get the most for your money if you lock in your good rate now, even if you won't be making your transfer for months.

If you want to send money at a specific rate, usually one that's better than the rate currently available, you can set up a market order.

You set a target rate which you'd like to send money at. When it’s reached, we immediately confirm your transfer and notify you via email. You must then make your payment to us to settle your contract.

You can change or cancel a market order at any time before the target rate is reached. Log in to your account on the Xe website and go to market orders to sign up.

Market orders and rate alerts are both tools that you can use to help you maximise the value of your future money transfers. The big difference between the two is the commitment to send money. One is legally binding while the other is purely informative. Here’s an explanation:

A rate alert is an alert letting you know that it could be time for a transfer. It informs you that the rates are in your favour, but it’s up to you whether you want to make a transfer at this time. If you regularly make transfers (for purposes like sending money to an account in another country or family abroad), rate alerts will let you know the best time to do so. The rate alert function is available on the app and online.

A market order places an order for a future transfer. You’ll enter your currencies, amount to transfer, and desired rate, and your currency will be purchased as soon as your desired rate is achieved. You’ve entered into a legally-binding agreement with us and we’ll send the money immediately upon settlement. Our Market order function is only available online.

We work with a network of global partners to send your money quickly and securely, which also helps us to avoid charges where possible.

The route your money will take is determined by several factors and the information you provide us with, including the currency you’re sending and where you’re sending it to.

This means you may sometimes notice a small change in your send rate as you progress through the money transfer process.

There are a few reasons why the send rate may change during the process of booking a transfer. We’ve outlined the most common reasons below.

We use live rates

At Xe we pride ourselves on using live rate.

The market rate for your transfer can change from the point you start your transfer to the point you confirm it.

Usually this takes no more than a couple of minutes and you’re not likely to see much change at all unless the market is very active. If it is very active, your send rate may change.

Your transfer does not qualify for the original rate

We’ll always try and send your transfer at the best rate.

However, some of our partners are unable to accept certain types of transfers. These are usually payments to businesses and some reasons for transfer.

While these are the exception, when you add this information to your transfer the system will automatically re-price your transfer. In this case, your send rate is likely to decrease.

We always tell you when your send rate changes

When you are asked to confirm your transfer, we’ll always tell you if your send rate has changed during the process. Look out for the banner message at the top your screen.

Either way, you can rest assured that we’re always looking to send your transfer at the best rate and in the fastest time.

Sending your money

You can send money with Xe online, over the phone, or in our app at any time, and the process will take just a few minutes using the follow steps.

1. Sign up or sign in

Whether you’re signing in or signing up, it’ll be fast and simple.

You can sign up online or via our app. If you’re an existing user, sign in to your account online or through our app, or give us a call if you have questions about your upcoming transfer and want to speak with one of our currency experts.

2. Let us know what you want to send

In order to begin the process of sending money to another country, we’re going to need to know what you’re sending, where you’re sending it to, and how much you want to send. We’ll prompt you to enter:

Your starting currency (what you have and want to exchange from)

Your recipient currency (what you want to exchange to)

The amount you want to send

Once you’ve provided this information, we’ll give you the send rate for that pair of currencies.

3. Enter your recipient details

It doesn’t matter if you’re sending money to your family, your university, or even yourself. We just need to know where you want to send your money. You’ll want to have the following ready to go:

Your recipient’s name

Their banking details

4. Pay for your money transfer

There are a few ways that you can send us the money for your transfer. Depending on which region your XE account is in, we accept payments through the following forms:

Direct Debit (including ACH, EFT, Bill Pay, PayID, Bpay and Interac E-transfer)

Bank transfer

Credit or Debit Card

Not sure how you want to pay? Check out our article breaking down the differences between the payment methods.

Once you know how you want to pay, enter your payment details.

5. Confirm your transfer

Before you hit “Confirm money transfer”, you’ll be taken to a page where you can review your transfer. We recommend taking one last moment to look through the details to make sure that you’re satisfied with everything. That includes:

Currencies

Send rate

Send fee (where applicable)

Recipient information

Timing (how soon the transfer will be sent)

Happy with everything? Go ahead and confirm your transfer. After that, all you have to do is...

6. Track your transfer and watch it reach your recipient

Your job is done! From this point on, we’ll take care of it. We’ll send you a confirmation after you’ve initiated your transfer and once we’ve sent it. If you want more information on your transfer status, you can track it online or in the app.

We’ve been in the currency business for over 25 years and keeping your money and information safe is one of our top priorities. We’re owned by the multibillion-dollar NASDAQ listed company Euronet Worldwide and adhere to regulatory standards in every country we operate in, along with having enterprise-grade security measures in place.

We’ve built up our reputation as a secure service on years of trustworthy transfers. We’ve processed over $115 billion in 170 countries for over 112,000 clients. We know the money transfer business, and we are committed to creating a perfect transfer experience for you.

Transferring large sums of international currencies between banks carries a great deal of responsibility, and calls for:

State-of-the-art security, stable/scalable infrastructure, and infallible managed services.

Access to services for Anti Money Laundering and fraud prevention.

Deep, broad expertise in regulatory requirements international financial services.

Knowledgeable FX corporate trading industry experts.

App development and security geeks of the finest calibre.

University interns from innovative educational institutions like the University of Waterloo.

Understanding of risk management and the daily world events which influence currency valuation.

We offer detailed information about our data protection principles, the data we collect, how we collect data and how we use your data here.

We also inform you about your data protection rights and remedies as well.

Regulatory compliance

As an international company, our business is mandated to meet regulatory standards such as:

Europe's GDPR (General Data Protection Regulation)

Canada's Privacy Act

The US Privacy Act

Our corporate traders and forward contract options minimise the erosion of your money from fees and turbulent currency values.

In order for XE to meet our regulatory requirements as a financial services provider, we need certain identification documentation when our clients and prospects sign up for a free XE Money Transfer account. These regulatory compliance requirements include KYC (Know Your Customer) and AMLCTF (Anti-Money Laundering/Counter-Terrorist Financing).

These documents will be encrypted and stored securely based on regional regulatory requirements. XE is regulated by central banks and financial regulatory agencies the world over, including:

The Australian Securities and Investments Commission (ASIC)

The New Zealand Financial Markets Association (NZFMA)

The Financial Transactions and Reporting Analysis Centre of Canada (FinTRAC)

l'Autorité des marchés financiers (AMF) in the Province of Quebec

US Department of Treasury Financial Crimes Enforcement Network (FinCEN)

The Financial Services Authority in the UK

European Securities and Markets Authority

Verifying your identity

The documents we accept for proof of identification vary by country, but often include:

An original PDF image of your driver's license or passport.

A scanned image of a bank statement, utility bill, or other documents which confirm the mailing address you provide at the time of registration.

These files must be smaller that 5 MB in size, and be in one of the following formats: .jpg, .jpeg, .pdf, .png, .tif or .tiff.

If you have any questions or need clarification on the specific identification requirements of your country or region, please email transfers@xe.com

You can find our Terms of Service for businesses and consumers, along with other helpful resources here.

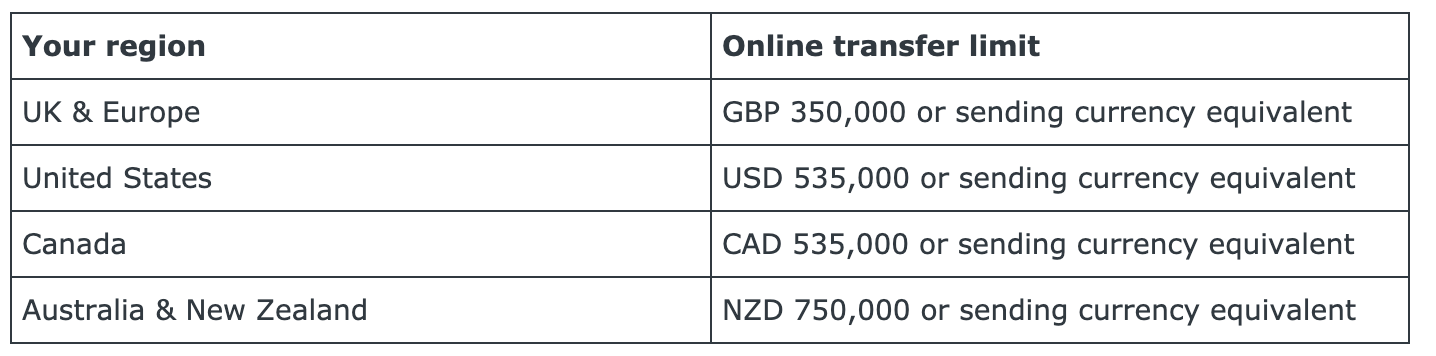

You can send very large amounts of money using our website and app, but we do have some limits.

These limits depend on which currencies you’re sending, how you’re paying and the number of transfers you’re making.

We’ll tell you if you exceed our limits. If you need to send more than your limit allows, contact us and we'll help arrange that.

We do have limits on how much money you can send with us, but there’s also the limits your bank can place on your account to consider.

If you are trying to send more money than your bank will allow at once, don’t worry, there’s no need to cancel or rebook your transfer.

We’re able to receive multiple payments for the settlement of a contract. Simply use the same reference for each payment you make to us.

If you’re unsure, please give our support team a call and they’ll be happy to walk you through the process.

Xe, HiFX and Continental Exchange Solutions are all part of Euronet Worldwide. Euronet is a world-leading electronic transactions and payments business and gives us greater global reach to help provide you with a faster and safer money transfer service.

We sometimes use bank accounts named either HiFX or Continental Exchange Solutions for transfers. Your money is safe with all of Euronet’s portfolio of companies and this will not affect your money transfer.

We only accept payment from an account in your name. You can’t send money from someone else’s bank account online or in the app.

However, we do understand there are a few exceptional circumstances where you might need to do this. For example, if you’re sending money from your solicitor’s account when making a large purchase, such as buying a property.

If you do need to make a payment from your solicitor’s account, contact us and we’ll help with these arrangements.

You should include a person's first and last name and bank account details. For a business transfer you need the business name and bank details.

You'll also need to include international transfer details such as IBAN, Swift or similar country codes. Don't worry, it's all explained as you set up your money transfer.

Yes, you can make changes by simply editing their details - such as choosing a different bank account for example. However, these changes can’t be applied to any money transfers in progress for that recipient.

What if I've already confirmed the transfer?

If you’ve already confirmed a money transfer and you need to change their details, you must contact us to do that. Please don’t place another another order as this just duplicates your money transfer requirement.

No one likes to be in the dark about what’s going on with their money. Here’s what happens when you make a transfer.

How does money transfer work?

There are two main types of transfers: intrabank and interbank transfers.

Intrabank transfers happen within one bank. If you transfer money to another account that you have there, or to a friend with an account at that bank. The money never leaves the bank, and the bank updates their records to subtract from your account and add to your recipient’s account.

Interbank transfers move money between two banks. Most international or long-distance transfers are interbank transfers.

If you’re making an international transfer, here’s what you need to know about the process.

You provide your bank information, your recipient’s bank information, the amount you’re transferring, and the currency you’d like to exchange to.

Once you’ve confirmed the information and your payment has been received, the transfer initiates.

There’s no physical money movement! Your money transfer facilitator will securely communicate the financial information to the banks or other involved parties.

This communication will then inform the banks or institutions to make the necessary changes to your accounts to reflect the transfer.

It’s a short process—your recipient should have their money within 1-4 business days. Most transfers are completed within the day.

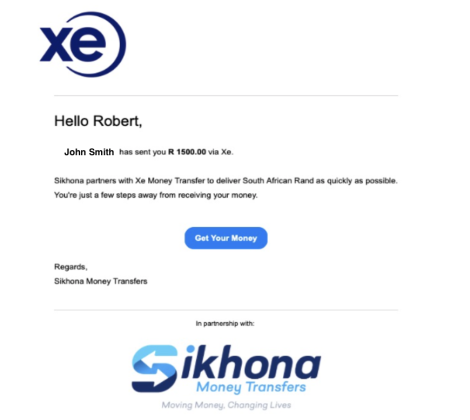

Need a fast way to send money to South Africa? Our partnership with Sikhona Money Transfers means you can send up to R5,000 daily (to a maximum of R25,000 a month).

Transfers sent via Sikhona require your recipient to complete a one-time registration to benefit from fee free transfers that typically arrive in minutes.

Don’t worry if you need to send more than Sikhona allows. Transfers over R5,000 will be send safely and securely using our standard Xe routes.

Why are you partnering with Sikhona?

We want to help you ensure that when you send money to South Africa, you’ll get a great deal and you know exactly how much you’ll receive on the other end. You'll get:

Great rates

Fast transfer times (arriving within minutes)

Absolutely no third-party fees

By partnering with Sikhona, we eliminate the risk of any charges being added by other banks when sending an eligible transfer via this route.

How much can I send?

You can still send the same amount of money you always have with Xe, just with the added bonus that transfers below R5,000 per day can be sent via our new partnership with Sikhona.

There is a daily limit of R5,000 for sending money via the Sikhona route and you can send a maximum of R25,000 per month in this way.

There’s no need to worry if you’re used to sending more than this with Xe. We can still provide you the same service you know and love.

Our generous daily limits for how much you can send in a single transfer online via our traditional routes still apply. Please find details of our standard Xe daily limits below:

Please note: Your bank or card provider may have their own limits and the Sikhona service is not used for business transfers.

How recipients complete the South African Reserve Bank check

We know you want to get your money moving as quickly as possible. Completing the regulatory checks is simple and won’t take long.

The recipient will be contacted by Sikhona via email and will need to click on the Get Your Money button in that email.

They’ll be asked if they’ve received money from Xe before and if they have a South African mobile number.

Don’t worry if the recipient doesn’t have a South African mobile number, they can still complete the checks and will just be taken via a different route.

They’ll be asked for some personal details and to supply a picture of their passport photo page as well as a selfie alongside it.

Your recipient will receive further communication from Sikhona once the check has been completed.

Do I need to complete the check if I'm sending money to myself?

All recipients will need to complete South African Reserve Bank reporting requirements before they can receive ZAR from abroad.

If you’re sending money to yourself, the same rule applies, and you’ll be contacted by Sikohna Money Transfer to complete this check.

You'll only need to complete this check once.

Where can I send from?

You can send money from any of our supported locations, as long as it is from a bank account in your name and matches your business purpose.

For example, If you hold a personal Xe account, you should only book personal transfers on here.

The funds must be settled from your personal bank account which is in the same name as your account with us.

The same applies to business transfers.

How long will it take?

It takes between 0 - 3 days for your money to reach Xe, depending on how you pay for your transfer. Once we receive your funds we make payment to your recipient.

Most transfers will arrive on the same day, but occasionally some recipient banks can take between 1 - 4 days to deposit the money in your recipient's account.

We will send you a notification at each stage of your transfer so you know where your funds are.

We can only accept payments from an account in your name when using our website or our app.

However, we understand many people use joint accounts and require the need to send money from these. We can help with that.

To help protect you and your money, we need to be able to trace that the transfer has genuinely been made by you using your joint account.

Sometimes the money arrives in our system without both names on the account being visible, making it impossible for us to confirm where it has come from.

Don’t worry. In cases like this, we may just need to contact you to confirm everything is correct before we can send your money.

Let us know if you’ve any questions and our team will be happy to guide you through the process.

To send or receive money internationally, your bank or any other financial institution must know where to send the money. BIC/SWIFT codes are the key to this.

BIC stands for Bank Identifier Code, and SWIFT stands for the Society for Worldwide Interbank Financial Telecommunications. Sometimes, people use the terms “BIC” and “SWIFT” interchangeably.

A SWIFT code or SWIFT ID typically identifies banks and other financial institutions worldwide, for international transactions.

More specifically, it says who and where these institutions are, so that your money goes to the correct place - you might even think of it as a global identity card for banks.

The International Organization for Standardization (ISO) recognises and approves SWIFT codes for financial and non-financial institutions. Right now, there are over 40,000 live SWIFT codes in the world.

What does a BIC/SWIFT code look like?

SWIFT/BIC codes contain 8-11 characters that identify your city, country, bank, and the branch of your bank. The code may look something like this:

AAAABBCCXXX

Looks complicated? Don't worry, here's an explanation of the format:

AAAA: 4-letter bank code that’s usually a shortened version of your bank’s name.

BB: 2-letter country code that represents the country in which the bank’s located.

CC: 2-character location code, pointing to the place where the bank’s head office is situated. It’s made up of letters and numbers.

XXX: 3-digit branch code that specifies a particular branch of the bank, usually the bank’s headquarters. These last 3 digits are optional, though.

Why do I need a BIC/ SWIFT code?

If you want to send money around the world, you’ll almost always need to use a SWIFT/BIC code. That’s because money transfers technically don’t transfer money around the world.

Banks securely transmit information to one another through the SWIFT system or their other channels, which lets them know where the money should come from (which account should be debited), and which account should be credited with the money. In short, without this code, your bank won’t know where exactly they should send your money to.

When you use an international money transfer app like Xe, you’ll have to enter the BIC/SWIFT code of the recipient’s bank for sending money to the recipient, because the money will travel from your bank account to your recipient’s bank account.

Not sure where to find your BIC/SWIFT code? Don’t worry, there’s a few places you can check to find yours.

Check your bank statements

You can usually find your bank’s BIC/ SWIFT code in your bank account statements. If you’re using an online bank, log into your digital bank account to easily view your bank statement.

Check your bank’s official website

Visit the bank’s website and check their Frequently Asked Questions (FAQs) section, international wire transfers, and other related links for their BIC/ SWIFT code. If there’s a search feature on the website, enter “SWIFT code” in the search box.

Contact your bank

In case you still can’t find the BIC/ SWIFT code, reach out to your bank via live chat, phone, social media, or email.

What is an IBAN number?

IBAN stands for International Bank Account Number. It is a standardised format for displaying a user’s bank account information, specifically used when transferring money between different countries.

What is it used for?

The IBAN aims to reduce errors and improve validation of cross-border payments.

What does it look like?

It can be up to 34 alphanumeric characters and contains the following:

A two-digit country code

Two check digits (which validate the existence of an account)

A bank account number (which contains specific details about both the bank and user account)

For example, a UK IBAN number could look like this: GB29 NWBK 6016 1331 9268 19.

This contains the country code, the bank identifier, the branch identifier and the account number.

How do I find my IBAN?

The money transfer recipient should get this information from their bank since it generates the IBAN.

Both the IBAN and BIC can usually be found on a bank statement.

You can check your IBAN by clicking on this link.

Do I need an IBAN to send money?

An IBAN and BIC are required to send money to countries that have an approved IBAN format.

Some payment providers will request the sender provides both pieces of information whereas others will only ask for an IBAN because they can calculate the BIC on the sender’s behalf.

We like to think of forward contracts as the buy now, pay later option. You’ll pay a small deposit now, but you won’t make the bulk of your payment until your set transfer date.

When setting up a forward contract, you’re making an agreement to transfer:

A predetermined amount of a certain currency

To another predetermined currency

At a predetermined date

At a locked in currency exchange rate.

In short, you let us know what you’re exchanging, how much you want to transfer, and when you want to make the transfer, and your transfer will be sent on that date.

So, if the rates are in your favour but you aren’t planning on making a payment or purchase just yet, you can still take advantage of the favourable rate without having to make your full transfer. Simple!

If you’re looking to send money soon, but the rates aren’t favourable at the moment, you can set up something called a market order.

When you make a market order, you can specify your target rate at which you’d like to exchange your currencies. The current rate doesn’t matter. The foreign exchange markets are constantly moving and we’ll monitor them for you.

After you’ve placed your market order and set your target rate, your work is done, and we'll take it from here. Once your rate is achieved, your contract is created automatically and we’ll notify you via email, allowing you to transfer currency at your ideal rate. You must arrange your payment to us at this point as part of your legally-binding agreement.

When would I need a market order?

Market orders are a great option for transfers that aren’t time sensitive. Some transfers, such as bills or educational payments, need to be made by a certain date, but if your transfer doesn’t come with its own hard deadline, you can take advantage of market orders to make the most of your money when making a transfer. You choose your ideal rate and we’ll let you know when you can get your money moving at this point.

Having your bills set up to be paid automatically is a great way of managing your finances and ensuring you never miss a payment. If you regularly make international money transfers for specific reasons, then you should consider automating this process. Through our Regular Payments Abroad (RPA) product, you can make regular, automated international money transfers, just like your usual direct debits.

When should I use RPA?

This feature is available to anyone who needs to make a regular series of money transfers. You might like to use this option to make the following types of regular payments:

Mortgage payments

Pensions

Paying salaries

Child maintenance or child support

Bills and maintenance for overseas properties

Timeshare fees

Court costs

Credit card payments

Medical bills

Education fees

But these are far from the only reasons for setting up an RPA. If you want to make any type of monthly or quarterly transfers, you could benefit from an RPA. Let us know what you need one for and we'll help you arrange it.

Why should I use RPA?

You could just manually make your payments each month or quarter, but switching to an RPA will have the following benefits:

Peace of mind: Life can get busy, and it’s easy for things to slip your mind. If you’ve set up RPA, you can rest easy and know that your transfers will always go out on time, even if you’ve been distracted with other things.

Convenience and accuracy: In addition to saving you time, as long as you’ve entered all of the correct information you can ensure that you won’t ever make an error in one of your transfers.

Fixed rate: When you set up your RPA, all your transfers for the period will be made at the same rate. They are unaffected by changes to the market.

Through our Regular Payments Abroad (RPA) feature, you can make regular, automated international money transfers, just like the automated bill payments you make at home. It’s a simple process to set up a RPA, but it’s not one that can be done online or in the app, so you’ll need to call us and give us the following information:

Your chosen currencies and provide your own details as well as your recipient’s information. This is the basic information that you’ll provide for any money transfer. It lets us know what you’re transferring, where it’s going, and how you’ll be paying.

How often you’ll be transferring. You can make your payments on a monthly or quarterly basis.

How long you’ll be making regular transfers. Everyone’s needs are different, but typically RPAs are set to make regular transfers for a period of 6 to 24 months.

Tracking your transfer

Once you’ve sent your transfer, you’ll want to follow its progress. We’ll send you a confirmation after you’ve started your transfer and once we’ve sent it.

If you want more information on your transfer status, you can easily track it online or in the app. Go to Track and you can see what's happening with all your money transfers.

When you confirm your money transfer, you'll see the expected payment date. You can also track your transfer in the app or on the web.

The expected payment date is an estimate and not a guarantee that the money will arrive in your account at this time. If your money is delayed more than 24 hours beyond the expected date and you’re concerned, contact us.

There are several things that may slow the progress of your money transfer and you should consider these before contacting us to find out where your money is:

Recipient details

Have you got all the details correct for the person you’re sending the money to? Small mistakes like misspelling a name or errors like giving us the wrong account number can cause problems.

Transfer time

We let you know as soon as we transfer the money to your recipient’s bank, who then credit it to the recipient’s account. Sometimes, this takes up to 3 or 4 days. If you’re concerned it’s taking longer than the estimated payment date, contact us and we can ask the recipient’s bank to confirm.

Payment method

When we receive your money, we settle your contract and send it on to your recipient. When you pay by card, that takes just minutes. When you pay by bank transfer, Direct Debit, ACH or similar, it depends if there are any delays in your bank depositing the money in our account.

More information required

Sometimes we need to make additional security checks and that can slow things down. Check your emails for any requests from us for further information. We may ask for proof of ID, source of funds or the legal documentation for changes to details. You can upload copies of these in the new app.

Local business hours

Some currencies are available to transfer 7 days a week (subject to change) and others currently only available during local business hours. That means it may take longer for a currency to arrive if you send money near the end of a business day, public holiday or at the weekend.

Non-domestic accounts

Sending money to an account where the currency is not the national currency of that bank may take longer e.g. sending USD to a USD bank account in China.

We know that when you send us money for your transfer you’re keen to know we’ve got it. Don’t worry. We’ll let you know as soon as we’ve received the funds into our account, there’s no need to call us.

You’ll be sent an email once we’ve got the money (don’t forget to check your junk folder in case it’s hidden in there) and app users will also receive a push notification if they’ve enabled them.

What determines how quickly we receive your money?

The payment method you’ve used, the currency you are sending and where you’re sending it from will all determine how quickly we receive your money’. Debit and credit card payments are usually completed quickly. Bank transfers and other methods can take longer, but rest assured our systems are safe and secure and we’ll be in touch when the money has arrived.

We’d normally expect funds to take no longer than a day to reach us, so if you’ve still not received any confirmation beyond this point, check with your bank or card provider to see if there has been a delay in the process.

Payment Methods

There's a variety of ways to pay for your money transfer with Xe. You can’t pay with cash, but our three main payment methods are:

Direct Debit

Wire Transfer

Credit or Debit Card

Depending on the options available to you, which are determined by your location, you could see a difference in how long your transfer takes and whether there are any additional costs added to your transfer.

Direct Debit

Direct Debit payments take funds directly from your bank account, without requiring you to make a card transaction or write a check. Once you’ve given us permission to take money from your account and signed the agreement, we’ll automatically deduct the funds from your account, without anything else required from you. There are some regional variations and you may have heard this process being called ACH (Automated Clearing House) or EFT (Electronic Funds Transfer) depending on where you live. We also accept Bill Pay, PayID, Bpay and Interac E-transfer.

In addition to being good for automated payments (which are ideal for regular payments like bills), Direct Debit payments won’t come with any added fees. However, these payments typically take longer to process, so this method might not be the best if you’re on a deadline.

Wire Transfer

One of the most well-known payment methods, wire transfers will move money from bank to bank. Wire transfers are one of the faster methods of payment; we typically receive money within 24 hours of the wire being sent. In addition, the other payment methods may have limits to how much money they can move in one go, while wires have no trouble with high-value transfers.

Unlike Direct Debit payments, wire transfers aren’t free. In order to move your money quickly between institutions, you will have to pay a small fee.

Credit or Debit Card

Like wire transfers, card payments typically offer a quick turnaround for your payment, allowing you to send your transfer ASAP. However, like wire transfers, some credit card payments come with a small additional fee.

Xe offers you an easy-to-use digital money transfer service. We don’t offer you the ability to pay with cash.

Depending on where you're located, you can pay for your money transfer by card, bank transfer or Direct Debit including ACH, EFT, Bill Pay, PayID, Bpay and Interac E-transfer.

If you’re paying us by bank transfer, then you’ll need to know our bank details. We’ve got many bank accounts located across the world and we’ll only give you the details you need to avoid confusion.

Sending us your payment by bank transfer

We’ll email you with all the details of your money transfer once you’ve completed your transaction. This email will contain a document which displays the details of your transfer and our banking information.

The PDF document is your contract note. Scan the contract note and you’ll find a section called ‘Payment Required from You’. This is where you will see our bank details, which you'll need when arranging your bank transfer.

Your payment can be made by telephone banking, online banking or visiting your branch directly. Payment should be sent as quickly as possible to avoid any possible delay to your transfer.

Please Note: Your contract note can also be found via the Transactions tab of our website once you’ve securely logged in to your money transfer account. Click the reference number which relates to your chosen transfer to access all the information you need.

How to find our bank transfer details if you're using the app

It’s even easier if you’re sending money using our app.

Once you’ve completed your transaction, go to Track and you’ll see your transfer is in progress, but you’ll be told we’re waiting for your bank transfer. You’ll be directed to view our bank details and be presented with instructions of how to pay us by bank transfer.

App users will also receive an email confirmation of their order, along with a contract note, which will also contain our bank details.

We are aware of an issue which currently prevents some of our Canadian customers paying via Bill Payment.

Unfortunately, you'll need to choose a different settlement method for now. To avoid delays, please refer to your contract note for our available settlement options.

We apologise for any inconvenience and we're working quickly to restore your full service.

Troubleshooting

You can send money safely with Xe and if you’re at all concerned about a money transfer, stop and contact us before sending money.

There are some easy ways you can avoid falling victim to fraud or scams:

Never transfer money to someone you don’t know. The person contacting you will claim to be legitimate, but if you don’t know them, think twice before sending money to them, and verify their identity before you transfer anything. If someone claims that you need to transfer to their personal bank account for a charitable donation or a hotel stay, confirm with the organisation in question before making a transfer. If a stranger contacts you asking for a money transfer, your best bet is to just ignore them.

Go through official channels. Most charities will allow you to securely make donations on their websites, or will have a set system in place for making donations. Or, if you’re trying to settle a dispute with someone, get in touch with the support staff of the platform you’re using and ask them to help solve the situation.

Double-check everything. Verify the identities of everyone involved before you make a money transfer, and confirm that the situation you’ve been presented with is in fact reality.

Wait. Money transfer scams push you to transfer immediately. Step back to assess the situation and think about whether it makes sense.

Trust your gut. If something seems off, it probably is. Slow down, make a few online searches, and get the facts before letting someone push you into making a decision you’re not comfortable with.

The earlier you inform us of your intention to cancel, the more likely it is that we’re able to complete your request at minimal or no cost.

Here’s a breakdown of the different stages and how we can help:

Placing an order

If you’re in the process of sending your money using our system but haven’t yet confirmed the transfer, then you can quickly and easily cancel. In the app, simply click the cross icon in the top left-hand corner of your screen to stop the process. On the website, you can click ‘Go back’ to return to a previous step and edit details. If you want to cancel the transfer completely, simply close your browser window or select one of our other options in your toolbar at the top of the page. You can get as many quotes as you’d like from us without making a payment, if you don’t confirm the transfers.

Order placed

At this stage, your transaction is confirmed and your currency has been purchased at the agreed exchange rate. You do not have the option to cancel your transfer online. Please give us a call as soon as possible to discuss your request.

Order being processed

Your transfer is in the process of being paid out. You do not have the option to stop the payment or cancel your transfer online. If you wish to do so, please give us a call as soon as possible. We may be able to stop your payment for you in some cases.

Money sent

At this point your money has successfully been sent and will be in the account you requested. We can’t cancel your transfer at this stage. The quickest way to get your money back is to get in touch with the person who has been sent the money and ask them to return it. If the money was sent to one of your own accounts, then you can simply arrange a transfer back to where it was sent from.

Alternatively, you can call us to place a recall on the funds. This process can take a few days and would require the approval from the recipient to grant us a debit authority to recall the funds. We cannot enforce this.

What can you do if you think you’ve sent your money to the wrong person? There’s a few ways you can sort this problem out, but you need to track the status of your transfer before working out how you can fix the issue.

If we’re still processing your payment or have received your money but not yet sent it, you may still be able to cancel it. Give us a call as soon as possible. The quicker you act, the more likely it is that we’ll be able to help you.

If your money has been sent then things can be a bit more difficult. At this point your money has successfully been sent and will be in the account you requested. We can’t cancel your transfer at this stage.

What should I do if my money transfer has already been completed?

The quickest way to get your money back is to get in touch with the person who has been sent the money and ask them to return it.

Alternatively, you can call us to place a recall request on the funds. This process would require the approval from the recipient to grant us a debit authority to recall the funds. We cannot enforce this, so you’re relying on the person who’s received the money to assist you.

We always send the exact amount you ask us to when you confirm your money transfer. We’d never send less.

However, there are rare occasions where the person you’re sending the money to may receive less than expected. This is beyond our control. Sometimes the recipient’s bank or an intermediary can add a fee which is then deducted from the amount received by your recipient. They don’t inform us if they do this so we can’t let you know in advance.

If you’d like more information about any charges imposed, we suggest asking the receiving bank for an incoming ‘MT103’, which is a payment document that contains details of the route the money has taken.

Keeping your money safe

We’ve been in the currency business for over 25 years and keeping your money and information safe is one of our top priorities. We’re owned by the multibillion-dollar NASDAQ listed company Euronet Worldwide and adhere to regulatory standards in every country we operate in, along with having enterprise-grade security measures in place.

We’ve built up our reputation as a secure service on years of trustworthy transfers. We’ve processed over $115 billion in 170 countries for over 112,000 clients. We know the money transfer business, and we are committed to creating a perfect transfer experience for you.

Transferring large sums of international currencies between banks carries a great deal of responsibility, and calls for:

State-of-the-art security, stable/scalable infrastructure, and infallible managed services.

Access to services for Anti Money Laundering and fraud prevention.

Deep, broad expertise in regulatory requirements international financial services.

Knowledgeable FX corporate trading industry experts.

App development and security geeks of the finest calibre.

University interns from innovative educational institutions like the University of Waterloo.

Understanding of risk management and the daily world events which influence currency valuation.

We offer detailed information about our data protection principles, the data we collect, how we collect data and how we use your data here.

We also inform you about your data protection rights and remedies as well.

Regulatory compliance

As an international company, our business is mandated to meet regulatory standards such as:

Europe's GDPR (General Data Protection Regulation)

Canada's Privacy Act

The US Privacy Act

Our corporate traders and forward contract options minimise the erosion of your money from fees and turbulent currency values.

In order for XE to meet our regulatory requirements as a financial services provider, we need certain identification documentation when our clients and prospects sign up for a free XE Money Transfer account. These regulatory compliance requirements include KYC (Know Your Customer) and AMLCTF (Anti-Money Laundering/Counter-Terrorist Financing).

These documents will be encrypted and stored securely based on regional regulatory requirements. XE is regulated by central banks and financial regulatory agencies the world over, including:

The Australian Securities and Investments Commission (ASIC)

The New Zealand Financial Markets Association (NZFMA)

The Financial Transactions and Reporting Analysis Centre of Canada (FinTRAC)

l'Autorité des marchés financiers (AMF) in the Province of Quebec

US Department of Treasury Financial Crimes Enforcement Network (FinCEN)

The Financial Services Authority in the UK

European Securities and Markets Authority

Verifying your identity

The documents we accept for proof of identification vary by country, but often include:

An original PDF image of your driver's license or passport.

A scanned image of a bank statement, utility bill, or other documents which confirm the mailing address you provide at the time of registration.

These files must be smaller that 5 MB in size, and be in one of the following formats: .jpg, .jpeg, .pdf, .png, .tif or .tiff.

If you have any questions or need clarification on the specific identification requirements of your country or region, please email transfers@xe.com

You can find our Terms of Service for businesses and consumers, along with other helpful resources here.

Keeping you and your personal information safe is our greatest priority. We want to help you to protect yourself from fraud attempts and have written blog posts and published tips on our website to help keep you and your loved ones safe. We help people avoid…

Phishing emails

Banking and online account scams

Online shopping scams

Lottery, competition and inheritance scams

Charity scams

We want to keep you and your money safe while you’re using Xe. One of the ways we do this is through a process called verification.

Verification is where we confirm your identity, just as you would do when registering for other financial services.

When we ask you to complete verification is determined by a number of factors, such as where you’re sending money from and how much you’re sending with us.

Typically, this process takes just a few minutes. Don’t worry. We’re here to help guide you through the process.

Why do you need to verify me?

We have a legal obligation to make sure you're genuinely who you say you are. It's as simple as that.

The information we gather during the verification process is used to protect the interests of Xe and our clients against financial crime.

How does it work?

As part of this essential process to prove you are who you say you are, we will sometimes ask you to provide a proof of identity and a selfie.

Occasionally, we will also need some additional information, such as a proof of address document or source of funds.

What we will need from you can depend on a number of factors, such as:

- The size of your transfer

- The country you are sending your money to

- The country you are sending your money from

All of this can be supplied online or in the app and we’ll check this to confirm your identity using safe and secure third-party verification services.

In most cases these checks are completed in real time and you’ll be ready to send money within a few short moments.

What documents will you need from me?

Our verification process will always explain what is required and how to provide it.

To ensure we can get you verified as quickly as possible and get your transfer confirmed, please also note the following tips:

- We can only accept images in colour

- Scanned copies will not be accepted on our platform

- We need to be able to see everything, so please ensure your image and information is not blurry and nothing is covered up

- If there’s information on the reverse side of your document, we’ll also need to see that

Please see below the specific requirements for your region.

Australia & New Zealand

If you're prompted for a valid identity document, we can accept any colour copies of the following:

- Your valid passport (the photo and signature pages)

- Australia or New Zealand’s driver’s licence

- National identity card (if photo is attached)

If you're prompted for a valid address document, we can accept any colour copies of the following (dated within the last 12 months):

- Utility bill

- Letter from a government agency

- Council rates notice or valuation

- Statement from any bank, building society or credit union

We're unable to accept any of the following:

- Credit card statement

- Mobile phone bills

Canada

If you're prompted for a valid identity document, we can accept any colour copies of the following:

- Canadian driver’s license

- Your passport (the photo and signature pages)

- National identity card (if photo is attached)

We're unable to accept any of the following:

- Canada Pension Plan statement of contributions

- Original birth certificate

- Marriage certificate

- Divorce document

- Citizenship certificate

If you're prompted for a valid address document, we can accept any colour copies of the following:

- Any statement issued by a Canadian government body (federal, provincial, territorial or municipal)

- CRA Notice of Assessment

- GST refund letter

- Utility bill (electricity, water, telecommunications, internet) dated within the last 3 months

- T4 statement

- Investment account statements (RRSP, GIC, etc.)

We're unable to accept any of the following:

- Credit card statement

- Insurance document

- Old lease agreement

European Union

If you're prompted for a valid identity document, we can accept any colour copies of the following:

- Your passport (the photo and signature pages)

- A photo driver’s licence

- National identity card (if photo is attached)

If you're prompted for a valid address document, we can accept any colour copies of the following:

- Utility bill (dated within the last three months)

- Bank statement (dated within the last three months)

- Local or national tax authorities letter

- A solicitor’s letter confirming completion of recent house purchase

We're unable to accept any of the following:

- Provisional driving licence

- Credit card statements

UK

If you're prompted for a valid identity document, we can accept any colour copies of the following:

- Your passport (the photo and signature pages)

- A photo driver’s licence

- National identity card (if photo is attached)

If you're prompted for a valid address document, we can accept any colour copies of the following:

- Utility bill (dated within the last three months)

- Bank statement (dated within the last three months)

- Council tax bill (for the current tax year)

- Income tax self-assessment letters

- Local or national tax authorities letter

- Electoral register entry

We're unable to accept any of the following:

- Provisional driving licence

- Credit card statements

USA

If you're prompted for a valid identity document, we can accept any colour copies of the following:

- State Identification card

- Driver's license

- Your passport (the photo and signature pages)

If you're prompted for a valid address document, we can accept any colour copies of the following:

- Utility bill (dated within the last 3 months)

- Current lease agreement

- Bank statement of a checking or savings account (dated within the last 3 months)

- Any statement issued by a US government body (federal or state)

We're unable to accept any of the following:

- Credit card statement

- Insurance document

- Old lease agreement

What is a 'selfie' and why do I need to take one?

A 'selfie' is a digital photo of yourself. Some of our checks can only happen once we have both a picture of your proof of identity, as well as a picture of you.

To do this, simply follow these steps:

Select your document which you will use for verification

Take a picture of that document

Next, take a selfie, ensuring your face is inside the selected area. Please also ensure:

- You keep a straight face

- You aren't wearing any glassesThat’s it. You should be up and running shortly.

This isn't my first transaction, why am I being asked to do this now?

To help you get your transaction completed as quickly as possible, we now stagnate our due diligence process.

This means that from time to time, we may need to ask you for more information to support your transactions.

As you continue to transfer with us, we may ask you for information such as the source of your funds, some more information about who you are or the purpose of your transfer.

By doing this, we ensure that you don’t have to deal with anything that is not strictly necessary for your purposes.

I don't have these documents with me, can I do it later?

We appreciate that these checks can sometimes appear at inopportune moments, and often you may not have these documents on hand.

Don’t worry. You can always select ‘do this later’ and come back to it at a more convenient time.

If you’ve selected this option and are looking to upload your documents, head to Track, where you should see an option to upload your required verification documents.

Business transfers

We provide comprehensive international money transfer and currency risk management solutions, and our specialists work with businesses of all sizes to improve their foreign exchange outcomes.

When you work with Xe, you don’t need to constantly check the markets and worry about when the best time to make your payment. We’ll watch the markets for you and help you access the best, most competitive exchange rates. The same range of money transfer solutions available to customers our offered to our business users as well, these include:

Spot Transfers – Need to make a quick payment? Make an immediate transfer at the live exchange rate. No wait, no fuss.

Market Orders – Got time before you need to transfer? Set your target rate and send your transfer automatically once it’s live.

Forward Contracts – Like the rates? Lock in the current exchange rate for a future transfer within 3 years.

No matter what industry you work in or what size your business is, we can work with you to help you find the currency and money transfer solutions that will best meet your needs.

Mass Payments

If your business is making frequent international payments in high volumes, that can quickly add up and be a major drain on your time and resources, particularly if you’re a smaller operation. Fortunately, Xe Mass Payments can help you to simplify and streamline your global payments to make the process quicker without sacrificing accuracy and security.

Some of the features include:

Processing and transferring 139 currencies to 220 countries

Improved transfer speed

Automated payment verification and validation

Hands-on support

Available as a standalone platform, managed service, or fully integrated API

Currency Data API

Exchange rates can be complicated. The markets are constantly moving, and when you have multiple currencies that you want to monitor, tracking can easily grow overwhelming. Our Currency Data API service will allow you to easily access competitive rates, track your transactions, and display multi-currency pricing, all integrated within your existing software.