Send money to Thailand faster ⚡️

Get access to our great exchange rates on all transfers through Xe!

2,400+ cash pickup locations throughout Thailand

Why use Xe to send money to Thailand?

✅ Competitive rates without any hidden fees

✅ Fast and safe alternative to the high cost of banks

✅ 120,000+ people trust Xe to send money each month

In four simple steps, you can send money to

It's quick and easy to send money to with Xe. Simply sign in to your Xe account or sign up for a free account. Then, enter the currency you'd like to transfer and the amount. Next, add your recipient's payment information. Finally, confirm and fund your transfer, and leave it to us!

1. Sign up for free

It takes just a few minutes. All we need is your email address and some additional information.

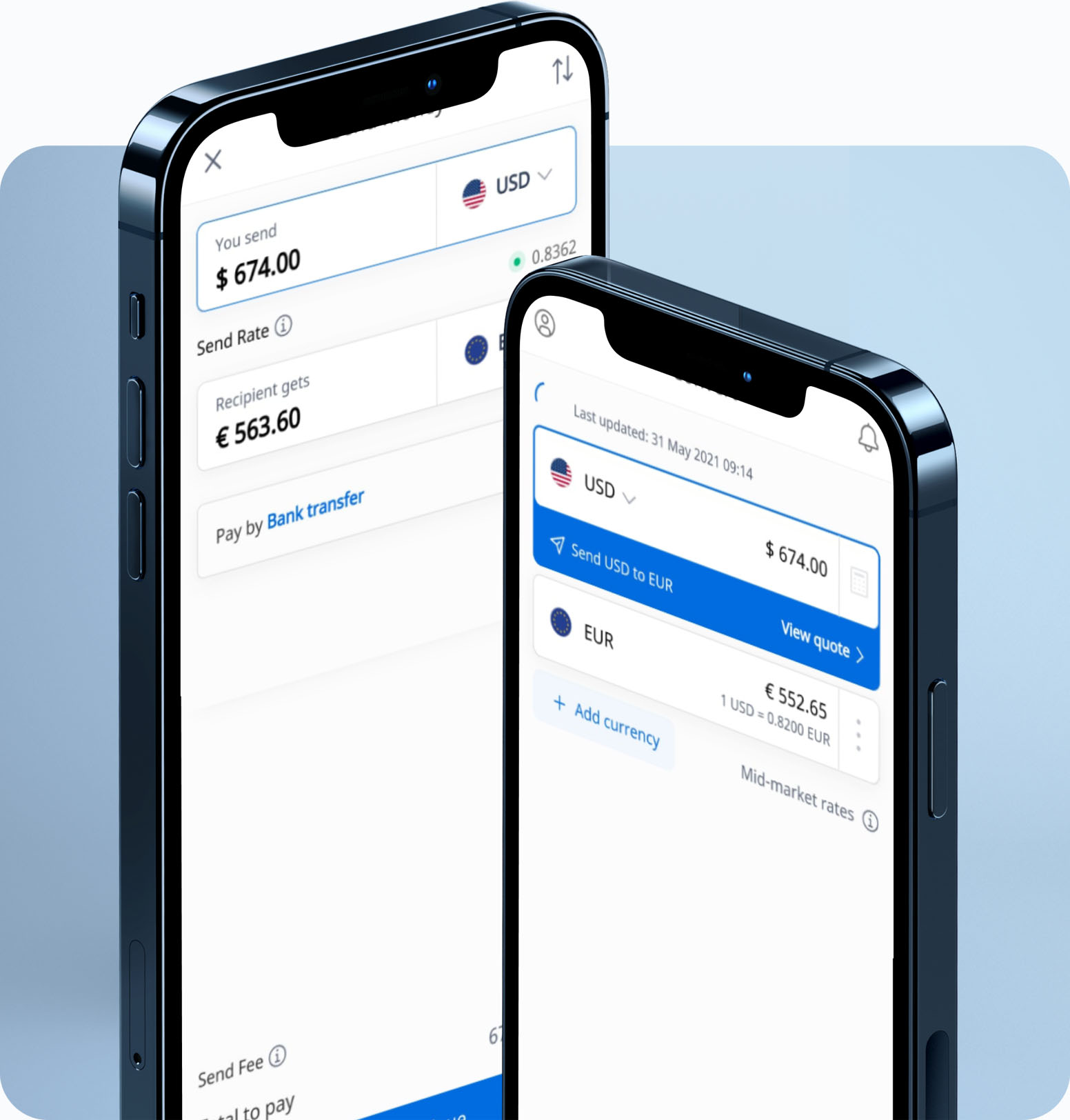

2. Start your transfer

Let us know the currency you'd like to transfer, how much you want to send and the destination.

3. Get the best rates

We offer great exchange rates, and we are transparent about any additional fees we may charge.

4. Send your money

We’ll inform you of the delivery times before you confirm your transfer. Send your funds to Xe, and we’ll keep you informed along the way.

How long does it take to send money to Thailand?

Sending money to () from () can take between just minutes up to 3 business days, depending on your payment method. On many popular routes, Xe can send your money as a same day transfer or even an instant money transfer once we receive your funds.

How much does it cost to send money to Thailand?

Take advantage of the current Xe sending rate of per for a transfer of today and the recipient gets . You may be able to pay by bank transfer for in additional transfer fees.

Recommended by 50,000 verified customers

With over 30 years of experience, Xe provides simple, fast and secure international money transfers. Find out what our customers love most about using Xe to send money abroad!

Download the Xe App to start sending money to

The Xe Currency app has everything you need for international money transfers. It's easy, secure, and there are no hidden fees. Download the Xe App for iOS or Android and start sending money to today!

Multiple payment methods to

There are multiple ways to send money to . Depending on your currency selection, you can use your debit card, credit card, a direct debit (ACH) or bank transfer.

Debit Card

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process.

Credit Card

Paying for your transfer with a credit card is easy and fast. Xe accepts Visa and Mastercard. Send money to with a credit card today!

Direct Debit (ACH)

When you use bank debit (ACH) to fund your transfer you are authorising a one-time debit from your bank account to ours. It takes a little more time for your money to reach Xe, and as a result, can delay the speed of transfer.

Bank Transfer

A bank transfer or wire transfer is an electronic payment which sends money directly from one bank account to another. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money.

Send money from + countries

Popular Destinations

Send money from United Arab Emirates to

Send money from Australia to

Send money from Bahrain to

Send money from Canada to

Send money from Switzerland to

Send money from Czechia to

Send money from Denmark to

Send money from United Kingdom to

Send money from Hong Kong to

Are you interested in sending money to ? It's fast, simple and easy.

As part of the Euronet Worldwide family, our customers trusted us last year to securely process over $115 billion worth of international money transfers. With transparent rates and a simple platform, we make it easy to send money abroad.

Money Transfer Frequently Asked Questions (FAQs)

Do you have questions about sending money to ? Read our FAQs to learn more.

It's quick and easy to send money to with Xe.

Sign in to your Xe account or sign up for a free account.

Initiate a transfer to the , and enter the currency you’d like to transfer and the amount.

Enter your recipient’s bank information.

Provide your payment information. We accept direct debit, bank transfers, and card payments.

Confirm your transfer, and leave the rest to us.

Some of our transfers to come with a small fee, depending on the amount you’d like to send and your payment method. We'll let you know about this fee before you confirm your transfer.

You should allow 1-4 working days for your money to arrive in , though many transfers arrive more quickly. Before you confirm your transfer, you’ll see a more exact estimate of when your money will arrive after we receive your funds.

You can send up to $535,000 USD (or the currency equivalent) to online. If you’d like to send more than that, you can contact our dedicated team to arrange a larger transfer.

The best way to for you to send money to will depend on what you’re looking for in a money transfer. The payment method you choose can impact the speed of your transfer, as well as whether you’ll need to pay any extra fees. You can read more about our payment methods here.

Send money directly to friends and family's mobile devices in 35+ countries with Xe.

Mobile wallets provide a fast, secure way to send, store, and receive money. Once we receive payment, the transfer is available in the recipient's wallet app within minutes.

Available to UK, Europe, Canada, New Zealand, and USA customers from app version 7.14.0 and online. Update your app for the latest features.

To send money to a mobile wallet:

Log in to your Xe account online or in the app.

Click 'Send' in the app, or 'Send money' online.

Choose the 'Destination country'.

Complete 'You send' or 'Recipient gets' field.

Select a payment method. For urgent transfers, use debit or credit card.

Choose 'Mobile wallet' as the delivery option.

Provide the transfer reason.

Pay for your transfer.

We'll send the money to the recipient's mobile wallet upon receiving your payment.