- Home

- Blog

- Currency News

- US Dollar Gallops Higher on the Back of Another Solid Job Report

US Dollar Gallops Higher on the Back of Another Solid Job Report

The US Dollar Index moved higher after non-farm payroll data (263,000 jobs created) exceeded market expectations of 181,000

May 3, 2019 — 4 min read

**Overview:**

The US Dollar Index moved higher after non-farm payroll data (263,000 jobs created) exceeded market expectations of 181,000

The Euro dropped below the key 1.12 rate as the euro bloc coming to a stall

NYMEX WTI crude oil resumes its slump, approaching key $60 a barrel

**Highlight:**

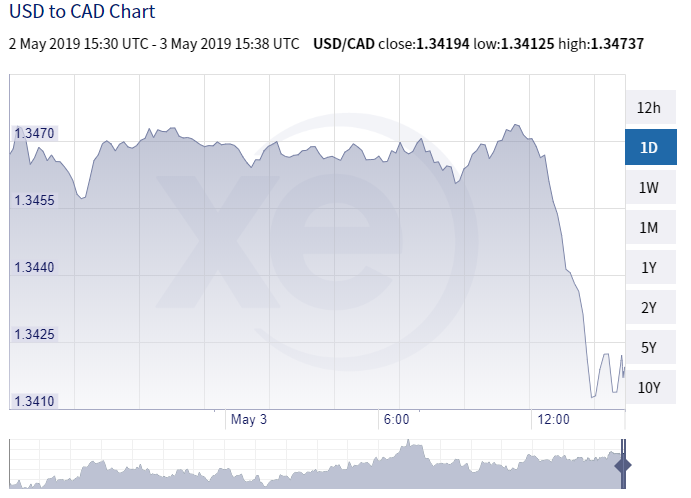

USD/CAD showed little reaction to another strong job creation report out of the US. The economy added 263,000 new jobs as per the latest news reports. While the market continues to assess incoming data, the currency pair stays inside the latest trading range. We, however, expect declining oil prices to start to weigh on the loonie.

US DOLLAR

The US dollar galloped to a five day high against the major currencies after reports from U.S. Bureau of Labor Statistics showed total non-farm payroll employment rose by 263k in April. The headline number was above market estimates. The unemployment rate fell to 3.6% (lowest since 1969), average hourly earnings rose by 3.2% over the past year, and there were net-upward revisions for the previous two months. US ISM Non-Manufacturing PMI declined to 55.5 in April from 56.1 in March.

The data in the report may come as no surprise; however, after FOMC recently reiterated that job gains remain solid in recent months. It will hard for the Fed to reign in a strong economy, be patient with the rates if inflation starts to point higher. We expect the US dollar to trade with a positive bias for the rest of the day. Fed officials will line up to share their opinions on the latest Federal Reserve decision. Commodity-linked currencies are meanwhile hurtling towards selling zone on the back of further weakness in the oil futures market. WTI is down 3% with crucial $60.00 a barrel on sight.

BRITISH POUND

IHS Markit/CIPS UK Services PMI Business Activity Index rose to 50.4 in April, up from March's 32-month low of 48.9. However, the data revealed a fall in new business for the fourth month in a row. Political chaos, Brexit uncertainty and concerns about the UK economic outlook have pushed the business community to shelve spending plans. GBP/USD waits for positive Brexit developments and remains highly volatile.

EURO

EUR/USD touched a five-day low and is trading below the 1.12 handle after reports showed the US economy continues to report solid job gains. The Old Continent and the US economy seem to be moving in different economy track with the former coming to essentially a complete stall.

Investors ignored the flash inflation report from the euro bloc this morning. Annual inflation was up 1.7% fuelled by higher energy prices but the ECB is unlikely to change its accommodative policy on these transitory factors.

CANADIAN DOLLAR

USD/CAD showed little reaction following the US job report, still trading near the higher end of recent trading ranges. However, we expect weakening oil prices to start to weigh on the loonie in upcoming sessions. WTI crashed by 4.25% yesterday and remains under pressure this morning. Surging output and inventory levels are pushing the black gold lower. The economic calendar is light as we move into the weekend and the US dollar-Canadian dollar pair is expected to trade with an eye on the key 1.35 post.

AUSTRALIAN DOLLAR

The Australian dollar dipped below the 0.70 mark before rallying against the US dollar. Despite strong non-farm job creation data and payroll increases, US PMI data disappointed. AUD currently sits at 0.701799.

FEATURED CURRENCY

USD/JPY failed to make higher gains, oscillating around the midpoint of 111. Lack of liquidity due to the public holiday in Japan and a cautious approach from the market is likely to keep the pair at current levels. Investors also prefer to avoid any heavy directional bets as US and Japanese officials look to resume bilateral trade talks.

**Online Money Transfers**

Moving funds between international accounts?

Sign up for XE Money Transfer and transfer money online 24/7.

You get free online quotes, so you know your costs before you book a transfer.