FX In E-Commerce: Multi-Currency Pricing And Payouts

January 23, 2026 — 5 min read

Table of Contents

Key takeaways

E-commerce FX risk often comes from timing and fees, not just spot moves.¹

“Local currency pricing” can improve conversion, but it changes how you manage margin and reconciliation.²

The best setups separate pricing decisions from settlement decisions and automate rules for both.³

E-commerce teams feel FX in places that do not look like “treasury,” like refunds, chargebacks, subscription renewals, and marketplace payouts. If you only manage FX at month-end, you often discover the margin leak after the fact.

This guide focuses on practical controls for 2026: pricing policy, checkout choices, settlement timing, and clean financial ops.

Where FX shows up in e-commerce

1. Pricing and localization

pricing in the shopper’s currency

rounding rules and psychological pricing

promotion mechanics across currencies

2. Payment acceptance and conversion

card networks and PSP conversion paths

optional conversion features at checkout

cross-border fees that can sit outside your headline rate

3. Settlement and treasury

when funds settle into your bank or wallet

whether you receive local currency or converted funds

how quickly you can redeploy currency to pay suppliers

Improving predictability and transparency in cross-border payments is a major theme in global payment roadmaps, and it applies directly to international commerce operations.¹

Local currency pricing vs base currency pricing

Local currency pricing (LCP) often improves conversion and reduces “surprise at checkout.” The tradeoff is you now own the FX management between sale and settlement.

A useful mental model:

LCP is a go-to-market decision

settlement strategy is a finance ops decision

Keep them connected, but do not mix them.

The four biggest FX margin leaks in e-commerce

Leak 1: conversion timing risk

You sell today, settle tomorrow (or later), and your conversion day becomes a random market day.

Fix: define a conversion rule:

convert immediately for small currencies

stage conversions for large volumes

hedge or lock for committed supplier runs

Leak 2: unclear fee stack

Some cross-border costs are easy to miss because they live in payment statements, not in your FX line item. Even general consumer explanations show how foreign transaction fees and related charges can apply depending on issuer and structure.⁴

Fix: build a “true cost per corridor” view:

rate applied

explicit fees

settlement currency and timing

refunds and chargebacks impact

Leak 3: refunds and chargebacks

If you refund in the customer currency but settle in a different one, FX can flip from tailwind to headwind quickly.

Fix: set refund policy by:

time window

currency

whether FX differences are absorbed or passed through

Leak 4: reconciliation gaps

FX becomes a reporting problem when you cannot tie:

order currency

settlement currency

net fees

refund currency

to one clean ledger record.

Fix: require consistent identifiers and automate mapping:

order ID in payment reference

settlement batch references

standardized fees mapping by PSP

A practical operating model for e-commerce FX

Layer 1: pricing rules

define price refresh frequency (daily, weekly)

define rounding rules per currency

define promo mechanics and currency conversion logic

Layer 2: checkout and customer experience

decide which currencies you accept

decide whether conversion happens at checkout or post-settlement

keep disclosures clear to reduce friction

Layer 3: settlement and funding strategy

decide which currencies you hold and why

plan supplier runs and payroll needs

reduce “deadline conversions” by scheduling and staging

A small table that helps teams align quickly

Area | Primary owner | Best KPI |

|---|---|---|

Local pricing strategy | Growth / product | Conversion rate, AOV |

FX cost visibility | Finance ops | Cost per corridor |

Settlement strategy | Treasury | Variance vs plan |

Reconciliation | Accounting | Close time, error rate |

FAQs

Should we always price in local currency?

Not always. If your volumes are low in a corridor, base-currency pricing may be simpler. LCP tends to pay off when you have repeat volume and want better conversion.

Is FX risk mainly about spot moves?

Often no. Timing, refund behavior, and fee stacking create more consistent margin leakage than a single spot move.¹

Do we need formal hedging to improve results?

Not necessarily. Many teams get large gains by tightening settlement timing, staging conversions, and cleaning reconciliation.

Wrap-up and how Xe can help

If you want calmer cross-border performance, treat FX as a workflow: price with clear rules, settle on a predictable cadence, and reconcile automatically.

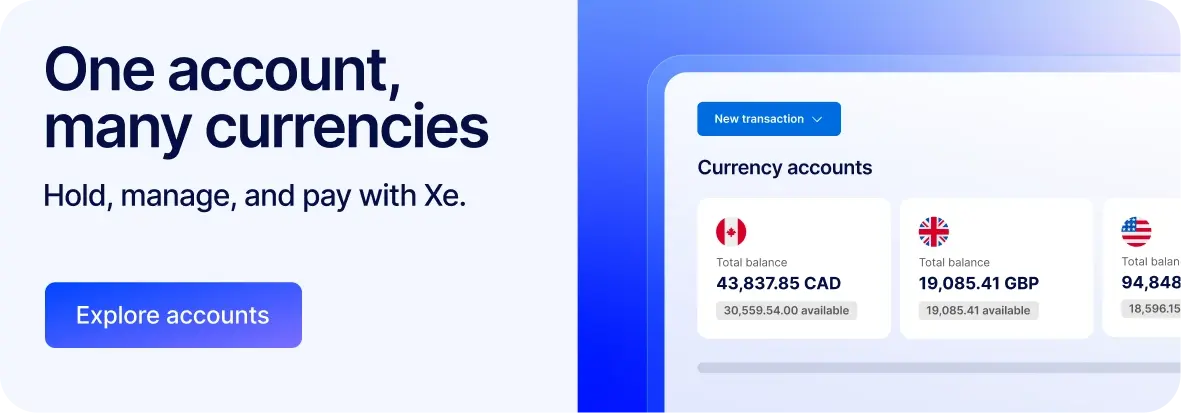

Xe Business can support e-commerce teams that need repeatable international execution:

International payments for overseas suppliers and contractors

Multi-currency accounts to hold key settlement currencies

Payment methods to understand options by corridor

Batch payments to run supplier payouts efficiently

Create a free business account

Speak to an FX specialist

The content within this blog post is for informational purposes only and is not intended to constitute financial, legal, or tax advice. All figures and data are based on publicly available sources at the time of writing and are subject to change. Actual conditions may vary depending on location, timing, and personal circumstances. We recommend consulting official government resources or a licensed professional for the most up-to-date and personalized guidance.

Citations

¹ Financial Stability Board / BIS CPMI — Roadmap to enhance cross-border payments — (2020).

² European Central Bank — SEPA overview (context on standardized euro payments environment) — (n.d.).

³ SWIFT — ISO 20022 overview (messaging standard context for payment data) — (n.d.).

⁴ Investopedia — Foreign transaction fee overview (general explanation of fee types) — (n.d.).

Information from these sources was taken on January 23, 2026.

Simplify international money transfers for your business

Xe Business makes it easy to pay global suppliers with fast, secure international money transfers, competitive rates, and no hidden fees.

February 20, 2026 — 8 min read

February 18, 2026 — 9 min read

February 16, 2026 — 7 min read

February 13, 2026 — 9 min read

February 11, 2026 — 8 min read