1,00 Corona sueca =

0,085665666 Euros

1 EUR = 11,6733 SEK

Conversor de divisas XE

1,00 Corona sueca =

0,085665666 Euros

1 EUR = 11,6733 SEK

1 SEK = 0 EUR

| Últimos 30 días | Últimos 90 días | |

|---|---|---|

alto Estos son los puntos más altos en los que la tarifa de cambio ha estado en los últimos 30 y 90 días. | 0,087273 | 0,089634 |

Mínimo Estos son los puntos más bajos en los que ha estado la divisa de cambio en los últimos 30 y 90 días. | 0,085609 | 0,085609 |

Media Estos son los tipos de cambio medios de estas dos divisas durante los últimos 30 y 90 días. | 0,086442 | 0,087935 |

Volatilidad Estos porcentajes muestran cuánto ha fluctuado el tipo de cambio durante los últimos períodos de 30 y 90 días. Seguir leyendo | 0,35 % | 0,35 % |

Nuestras clasificaciones de divisas muestran que la tarifa de cambio de Corona sueca más popular es de SEK a USD. El código de la divisa Swedish Kronor es SEK. El símbolo de esta divisa es kr.

More Corona sueca infoNuestras clasificaciones de divisas muestran que la tarifa de cambio de Euro más popular es de EUR a USD. El código de la divisa Euros es EUR. El símbolo de esta divisa es €.

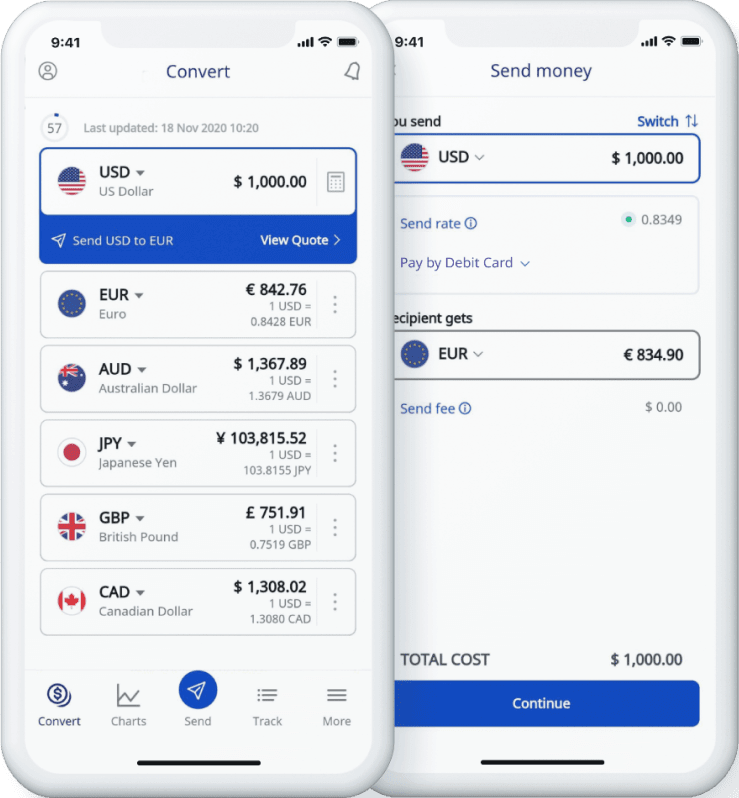

More Euro infoEnvíe dinero en línea de forma rápida, segura y fácil. Ofrecemos seguimiento y notificaciones en tiempo real, además de opciones flexibles de entrega y pago.

Cree un gráfico para cualquier pareja de divisas del mundo para ver su historial de divisa. Estos gráficos de divisas utilizan tarifas de mercado medio en tiempo real, son fáciles de usar y muy fiables.

¿Necesita saber cuándo una moneda alcanza una tarifa específica? Las alertas de tarifas de Xe le permitirán saber cuándo la tarifa que necesita se encuentra disponible en los pares de divisas seleccionados.

Apoyamos tarifas a nivel comercial en más de 300 compañías en todo el mundo

Más información...

, ratings

, ratings

, ratings