- Home

- Blog

- Life Abroad

- 5 Tips for Buying a Property in a Foreign Country

5 Tips for Buying a Property in a Foreign Country

2018年12月28日 — 5 min read

Are you considering the purchase of a property overseas, maybe as a holiday or retirement home? Have you been spending so much time on real estate investing websites, you are taking virtual home tours in your dreams?

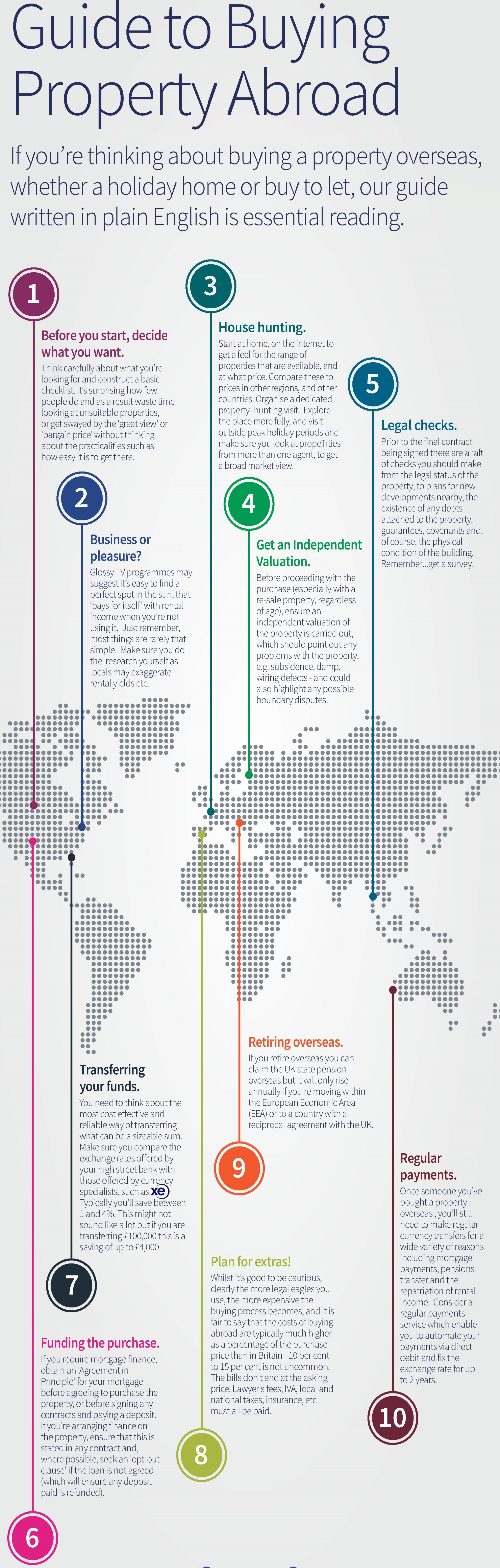

Here are five tips for expats, and expats-to-be, who are planning to move to a new country or expand their overseas property holdings. We've also included an infographic at the bottom of this article for soon-to-be expats from the UK.

1. Do Your Market and Regional Research

Whether you are buying your property from a stranger, a lifelong friend, or even a family member, it’s important to enter an international real estate transaction with your eyes open, your mind clear, and a firm grip on your wallet.

If you were buying a property in your own city, or across the country, you would likely work with a competent real estate agent and spend a significant amount of time touring homes and doing your due diligence. Yet when it comes to a vacation property or retirement home, emotions can sometimes take a stronger hold.

Depending on your origin and destination countries, your eligibility and ease of securing a mortgage in a foreign country will vary. You may have to make a significant down payment of up to 30%. Developer or seller financing arrangements may help you save on interest. Be sure to budget for transfer fees or stamp taxes as part of your property purchase.

If you’re preparing to buy a property in a foreign country, ensure you do as much research as you would on a domestic property, if not more. You might find resources like Realtor.com, RealEstate.com.au or EuropeanProperty.com helpful.

2. Be Cautious about New Builds or Fixer-Uppers

Many countries have new home warranty programs and regulations. If you’re looking at new homes abroad, be sure to do your research on local developers, and understand the implications of builder-responsible defects.

Further, you can find reputable tradespeople through regional contractor associations like European International Contractors, the North American Contractors Association or the Australian Construction Industry Forum.

These groups can help you navigate the local renovation market, as well as the local rules of law related to home zoning, building standards, and renovations. Or before you start your journey, check for online reviews on credible websites like Trustpilot.

If you buy vacant land or a previously occupied home, avoid entering a private property transaction without representation. Get professional purchase advice from a certified local real estate broker, agent or reputable developer. You can also ask real estate professionals in your home country for referrals to their counterparts in your destination country.

3. Understand Your Tax Responsibilities in Your Countries of Origin and Destination

You might live in your vacation home for a few months out of the year, the whole year around, or even use it purely as an income property via leases. Do your due diligence on your tax responsibilities relative to capital gains, safe-harbor provisions, income tax and any reporting responsibilities required by both your home country and the country where you buy the property.

4. Hire local legal representation

We've mentioned rules, laws, and regulations a few times, because their importance can’t be overstated when buying an overseas property. Mitigating risk when you set up residence in a foreign country is well worth the investment in hiring a local attorney or solicitor, as different countries will have different processes.

They can help you get important documents translated (not to mention translate the legalese) and advise you on potential legal exposures in your property purchase agreement. If you already have legal representation in your home country, law firms often have relationships with other firms in your destination country.

You can contact the nearest International Bar Association office in your destination region for additional guidance. When you’ve decided to acquire a vacation property in another country, or you’ve found the retirement home of your dreams overseas, your emotions can play a central role in your thought processes. Don't forget to check that you are also minimising your legal and financial risk to get more enjoyment from your investment.

5. Mitigate Your Foreign Currency Exchange Costs

When you are paying a significant amount of money for lease payments, maintenance fees or to purchase a home outright, transaction costs can start to add up. Some banks and foreign currency brokers may charge high fees, bury hidden costs or offer less-than-desirable exchange rates.

Before you go to your bank, it might be worth checking out the prices offered by a money transfer service provider. They may also offer specialist products that could help to save you time and money.

Ready to get started?

Register for an XE Money Transfer account today to find out how we could help you with your overseas property purchase.

The XE Graphical Guide to Buying a Property Abroad

Please note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information