- Home

- Blog

- Currency News

- New Zealand Economic Outlook - What to Look for as 2019 Unfolds

New Zealand Economic Outlook - What to Look for as 2019 Unfolds

2019年2月21日 — 5 min read

There are ten months ahead in what promises to be an interesting time for the leading economies of the world. According to the World Bank and the United Nations, New Zealand ranks 50th among leading world economies in terms of GDP. After our 2019 global economic outlook proved to be very popular with our customers and prospects, we called on Adam Cracroft to provide some insights on how he sees the leading economic influences on the New Zealand will drive growth and prosperity in coming months.

The NZ Dairy Sector

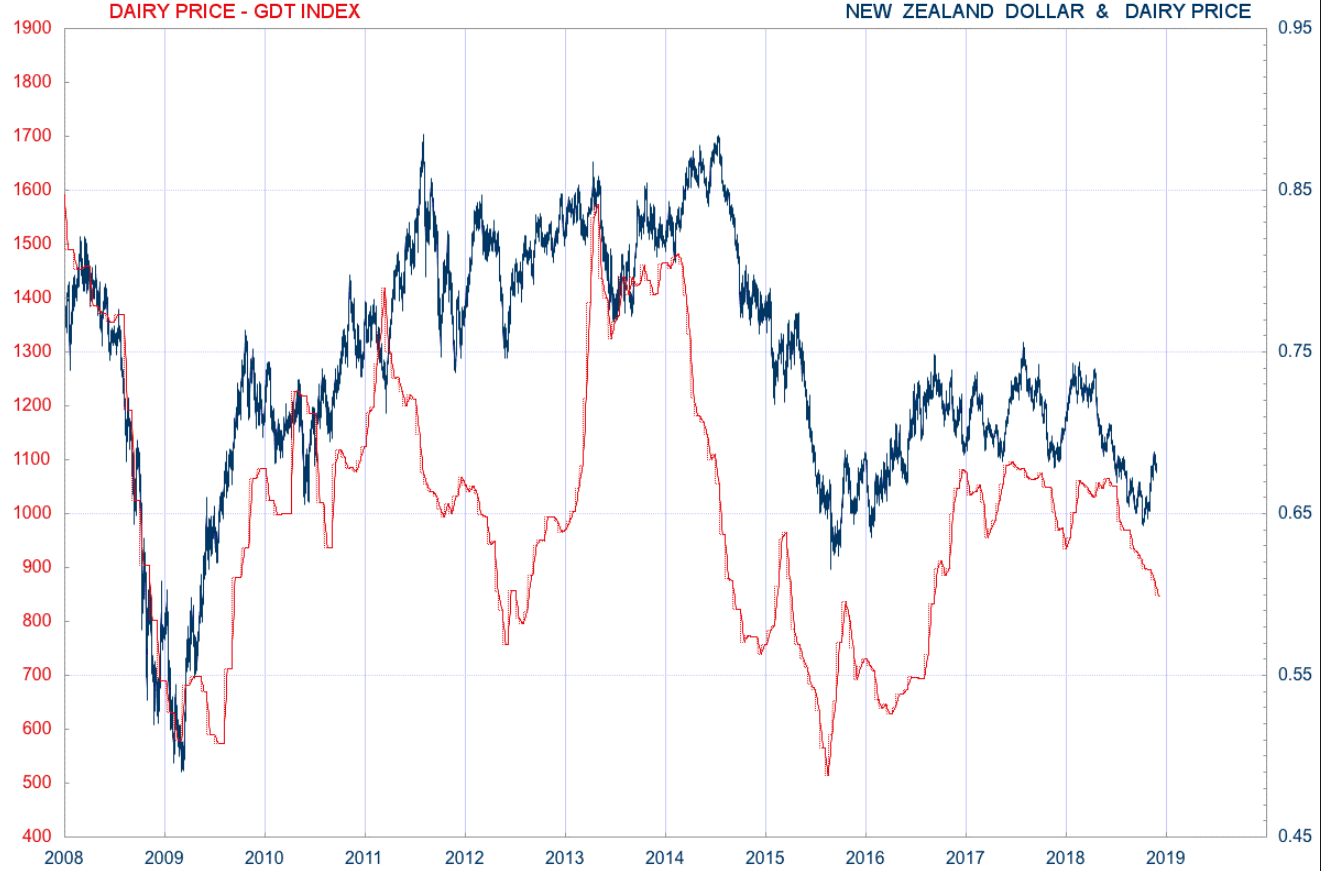

The NZ economy has slowly become less reliant on the dairy sector, but there is still a strong correlation between dairy prices and the NZD/USD.

Ongoing global dairy production strength has kept a fairly tight lid on prices, feeding concerns about a possible glut in supply.

Keeping an eye on dairy prices gives you a clue on what to expect from the NZD over the medium term, but it’s important to note this isn’t an unwavering factor, as seen during a big divergence in 2012. That's when the US went on a money-printing rampage, and significantly devalued their currency.

Dairy supply and demand trends are just one of the many factors we take into account at XE when we advise your business on developing a foreign currency policy. One of our guiding principles is to help our customers to deal with the risks posed to their company’s cash-flows through foreign exchange turbulence.

NZ Interest Rates

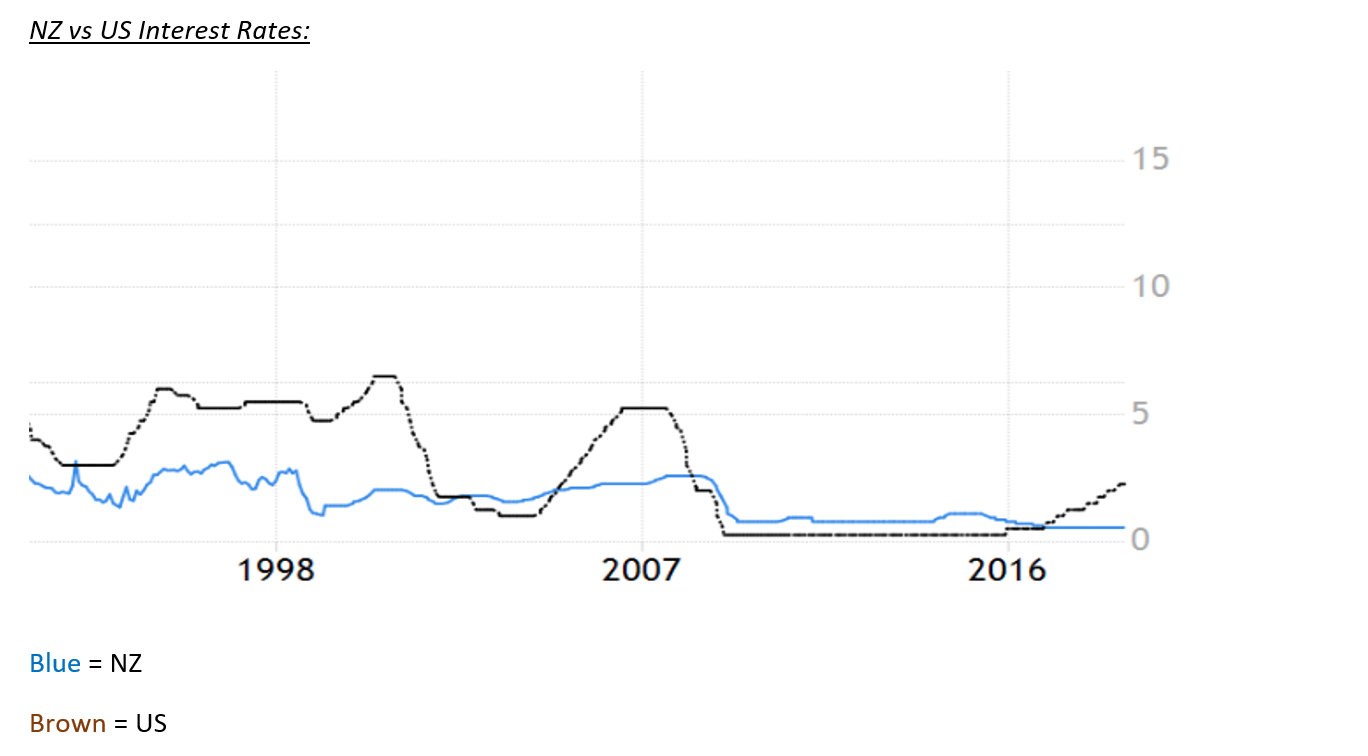

One of the big drivers of the NZD’s movements in 2018 was interest rate decisions from both the Royal Bank of New Zealand, and the US Federal Reserve.

From the RBNZ’s point of view, the NZ economy is in a sweet-spot, with low interest rates, a strong fiscal position, and growth trending above long-term averages.

So why are interest rates still on hold?

First, inflation has been stubbornly low. Even with accommodating monetary policy doing its best to foster growth. Wages have continued to flounder, but are starting to show signs of recovery, particularly with the government’s stated target of lifting minimum wage to $20/hr by April of 2021.

With this in mind, you could expect the RBNZ to lift interest rates, but we are still on hold. Their reluctance to raise rates appears to be due to a lack of inflation, still sitting stubbornly low at 1.7%, but within their target band of 1-3%. New RBNZ governor Adrian Orr seems happy for the economy to run hot before interest rates follow suit.

On the other side of the equation, we’ve seen the US interest rise rapidly in the past two years from 0.25 to 2.25%. This has increased demand for the USD given a stronger yield, pushing the NZD down in the process.

The rhetoric has changed from the Federal Reserve in December, indicating they are close to ‘neutral’ (neither stimulatory nor restrictive) which gave the NZD a late flurry in 2018.

Immigration

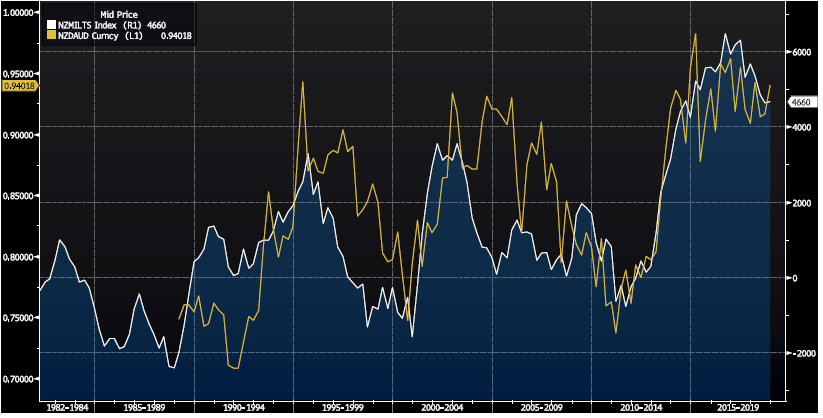

Although immigration might not stand out as a key figure to look at, there is a strong correlation between immigration into NZ and the NZD/AUD currency pairing.

The chart below shows that a drop in NZ immigration numbers has foreshadowed a fall in the NZD/AUD currency pair. Immigration has been severely curtailed by the Labour government, plummeting 28% in 2018 compared to last year, and shows no signs of trending up.

Australia’s reliance on China as a trading partner outweighs NZ, with 35% of their exports going into China compared our 22%. The Australian economy appears to have more to lose if US-China trade wars continue, bucking the trend seen below.

This may limit any downside between the NZD/AUD in the short-term with a similar lag being created to the 2004-2005 period.

Yellow = NZD/AUD Currency Chart

White = Immigration numbers into NZ

What’s next?

2019 looks to promise more of the same, with volatility remaining persistent, creating wild fluctuations in the NZD. At XE, we help our clients create a simple foreign currency plan which is designed to help protect their profit margins.

If you are a business owner or investor looking for advice on how to approach foreign exchange risks and opportunities, we'd be happy to set up a free, no-obligation appointment for you with Adam Cracroft, Senior Foreign Currency Exchange Consultant.

Feel free to connect with Adam via email at adam.cracroft@xe.com

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here:https://transfer.xe.com/docs/regulatoryinfo_xemtuk.pdf?_ga=2.21312891.1532176462.1543265461-1390602948.1478367085Regulatory Information