- Home

- Blog

- Currency News

- The Fed is Expected to Keep its Powder Dry and its Senses on High Alert

The Fed is Expected to Keep its Powder Dry and its Senses on High Alert

The Bank of Canada, as expected held the prime interest rate at one and three-quarters percent. US Fed Chair Powell hinted that an interest rate hike is coming.

10 luglio 2019 — 4 min read

**Overview:**

The market waits for the Fed Chair to deliver his economic assessment. In the meantime, G10 currencies remain calm.

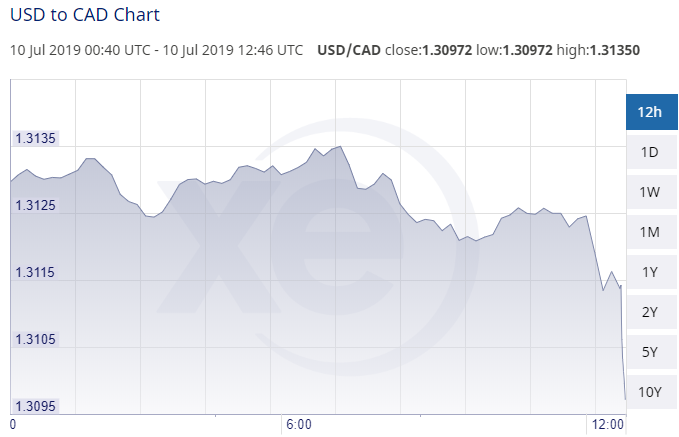

USD/CAD oscillates around the 1.31 handle ahead of today's rate decision from the Bank of Canada.

WTI Crude oil prices jumped 2.35% over geopolitical risks

**Highlight:**

The Bank of Canada will command the limelight this morning as it announced another no-change decision. The loonie has been trading firmer against the greenback, fuelled by relatively solid economic numbers. The medium-term outlook though remains cloudy with Canada's recent trade spate with China, and general market sentiment. We expect the pair to continue to trade within the current sweet spot.

US DOLLAR

The market is relatively calm this morning and waits for the Fed Chair to start his two-day testimony before the House Committee on Financial Services. He is expected to underscore, yet again, that downside risks have increased. He will discuss how trade tensions between the US and its international partners will have a bearing on global economic growth.

However, the Fed is expected to keep its powder dry and rely on incoming data amidst changing global economic landscape. Market participants will also have a chance to dig deeper into the minutes of the last FOMC meeting and gauge the next action from the Fed. We're watching Chairman Powell's testimony and will provide significants updates on developments as they occur,

Crude oil is trading 2.25% higher and is slowly reaching the Twitter-trigger point near $60 a barrel.

BRITISH POUND

Sterling is grasping at straws near its lowest 2019 level after UK GDP report revealed the economy expanded by 0.3% in May. The growth was supported by a positive contribution from the services and production sectors, but construction was flat slowing from a 1% rise in the prior month. Incoming economic data remains volatile and continues to inject uncertainty into the pound. The UK’s exit saga from the EU took a new twist and is expected to be bumpy after the House of Commons voted to prevent the next government from bypassing parliament.

EURO

EUR/USD is trading relatively flat around the 1.12 handle. Better-than-expected industrial production numbers out of France and Italy are providing temporary support to the shared currency. French manufacturing output increased by 1.6% in May after a no-growth performance in the previous month. In Italy, the production index surprised to the upside with a bump of 0.9% in May. These numbers are providing some relief to the beleaguered euro staring at a two-month low on economic concerns.

CANADIAN DOLLAR

The Bank of Canada is expected to deliver a bullish hold at 10 am ET. The market is already pricing in a no-change decision and will be eagerly reading into the statement to gauge the next action. Canadian economy remains fragile with the manufacturing sector in stagnation. USD/CAD is likely to be volatile post-announcement and any hint of policy divergence with the US Fed will encourage more CAD bulls. The pair lost nearly 3.45% of its spot value last month over trade tensions with China and cautious signals from Fed members.

AUSTRALIAN DOLLAR

The rise and fall of AUD USD continues today as the Aussie rose again to the mid-0.69s in advance of Powell's remarks.

FEATURED CURRENCY

USD/JPY is shedding gains, failing to breach the 109 mark. Investors are turning cautious ahead of Powell’s testimony and hence moving into a consolidation zone. Meanwhile, the Producer Price Index (PPI) declined by 0.1%, missing market expectations. Soft data out of Japan is expected to weigh on the yen once the testimony event risk clears.

**Online Money Transfers**

Moving funds between international accounts?

Sign up for a free XE Money Transfer account and transfer money online 24/7.

You get free online quotes, so you know your costs before you book a transfer.