- Home

- Blog

- Currency News

- All Eyes on Exchange Rates in the 6 Month Countdown to Brexit

All Eyes on Exchange Rates in the 6 Month Countdown to Brexit

As the calendar pages flip towards Brexit Day - March 29th, 2019, the world waits and watches to see if PM May and her parliamentary colleagues can strike an acceptable deal with their European Community counterparts.

11 octobre 2018 — 3 min read

With just under six months until Britain formally leaves the EU on the 29th of March 2019, there is still a lot of uncertainty around what the deal will be, what it could mean for the UK economy and the kind of relationship Britain will have with the EU in the future.

We have highlighted what we think are the key dates over the next 6 months as Britain looks to agree a Brexit deal in our Countdown to Brexit

The outcome (or lack of outcome in some scenarios) of these key events could create volatility on the currency markets and impact the value of the Pound.

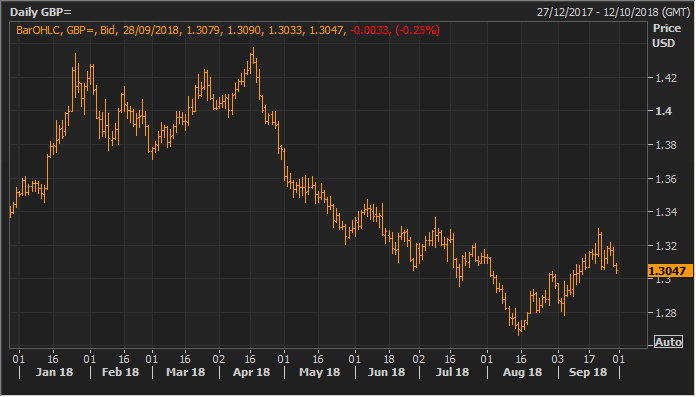

This year, we have seen Sterling trade in a range of 5.3% against the Euro, and 12% against USD.

The ongoing uncertainty around the Brexit negotiations and perceived instability within the UK Government have been key influencers. The major concerns are surrounding the agreement of the final deal with the EU, and whether Parliament will formally pass it.

In the US, the Dollar has been strengthening on the back of the increasing of US Interest Rates from circa. 1% to 2–2.25%. The trade war between the US and China is also having an impact on global growth and sentiment, and is driving investors into the perceived ‘Safe Haven’ of Japanese Yen.

GBPEUR 01/01/2018–28/09/2018. Source: Reuters

GBPEUR 01/01/2018–28/09/2018. Source: Reuters

Whatever happens, we’re always here to help you make your international transfers.

We can be your eyes and ears in the market, with a range of currency tools to help you monitor market movements.

With an XE account, you can also create personalised Rate Alerts to let you know when your desired exchange rate becomes available.

Nobody can know for sure what will happen over the next six months, or how the UK will be impacted once a deal has been agreed with the EU. But it seems reasonable to assume that there may be some volatility for the Pound whilst the deal is being negotiated.

If you’d like to discuss your situation with us in more detail, please contact usand our team will be happy to help.

XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information