- Home

- Blog

- Money Transfer

- What to Know About Transferring Money to Yourself

What to Know About Transferring Money to Yourself

For many people, money transfer is a convenient, secure, and cost-effective way to exchange currencies for their own use.

April 15, 2020 — 3 min read

When most people think about money transfers, they think about sending money to loved ones overseas, paying for a property purchase, or making some other payment. But not all transfers need to result in payment. For many people, money transfer is a convenient, secure, and cost-effective way to exchange currencies for their own use.

When and why would I transfer money to myself?

Planning to take an international trip? At some point, you will likely need your destination’s currency. Sure, you could just make the exchange through your local bank, at the airport, or at an exchange provider in your destination, but you can’t guarantee that those providers will give you a good rate. It’s more likely to be the opposite; these providers are free to set their own exchange rates, and these rates are going to be in their favor.

If you exchange currencies through money transfer, on the other hand, not only can you trust that you’ll get the true rate straight from the live markets, but you can also set a Rate Alert or a Market Order to let you know when your ideal rate is live or initiate your transfer at the targeted rate.

Or are you already in another country? Whether you’re temporarily working or studying in another country or you’ve completely settled down abroad, you will likely return to your country of origin at some point. Whether you’re visiting loved ones or moving back in the future, you’ll want to have some money in that country’s currency. And this brings us back to what we said earlier: while you can exchange currencies at banks or other providers, they likely won't give you the favorable rates that money transfer will.

The bottom line? When you transfer money to yourself, you can quickly and easily exchange currencies at a fair, honest rate. You can guarantee that you’ll get more for your money, wherever you are.

How do I transfer money to myself?

It’s a simple answer: the same way you’d transfer money to another person. The only difference in the process is that instead of entering another person’s name and bank information, you would provide your own.

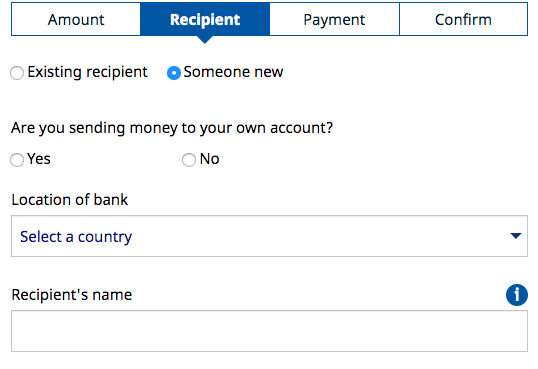

When you initiate a money transfer through Xe, after entering your currency exchange information, you’ll be asked who your recipient is. Select “Yes” in response to the question “Are you sending money to your own account?” in order to initiate a self-transfer.

Otherwise, the process is exactly the same as sending any other money transfer. Are you ready to get started? Check the rates and learn more about how to make your money transfer.