Make direct payments to the Australian Taxation Office with Xe

12 juli 2021 — 5 min read

This Australian tax season, we want to help make things easier for you.

We’re excited to announce that we have recently partnered with the Australian Taxation Office. We are one of the ATO’s two recommended payment methods to pay Australian taxes, and we’ve made some changes to our service to ensure that you’ll be able to send your tax payments, in full, directly to the ATO quickly and easily.

You can send money straight to the Australian Taxation Office in the Xe app.

How to send money to the ATO in the Xe app

If you don’t have an Xe account, it’s free to register and takes just a couple of minutes. Once you have an account, you can initiate the transfer process as normal to make your tax payment.

Ensure you allow up to 4 business days (prior to your payment due date) for payments to reach the ATO and appear on your account. If a late payment occurs, you are responsible for any fees or penalty interest that may be applied.

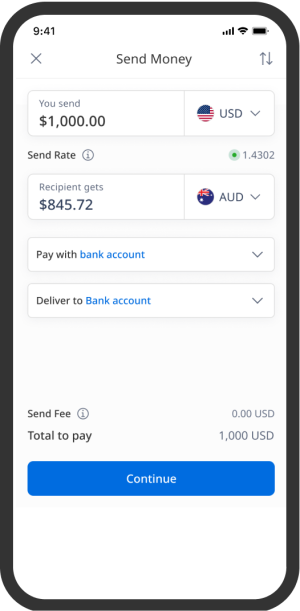

1. Open the Xe app and initiate a transfer to Australia (AUD)

Select Australian Dollar (AUD) as your recipient currency and enter the amount you’d like to send to get your transfer quote.

This quote will provide you with the send rate for your transfer, and let you know exactly how much AUD you'll send to the ATO (as well as how much you'll need to pay in order to send a certain amount of AUD).

This is the rate at which you'll convert your currency to send your tax payment. It won't matter if the rate changes in the future: your currency will convert at the rate live at the time you confirm your payment, and will send the full amount to the ATO.

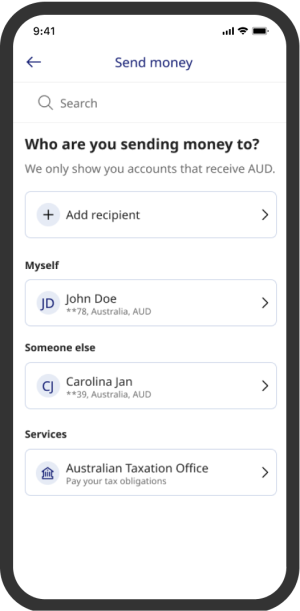

2. Go to ‘Services’ when prompted to enter your recipient details and select Australian Taxation Office

The ATO will automatically appear as a recipient option for any transfer initiated to Australia. You won’t need to do anything else to find them, nor will you need to enter any recipient information. We have the ATO’s information in our system, so we can send your money straight to them.

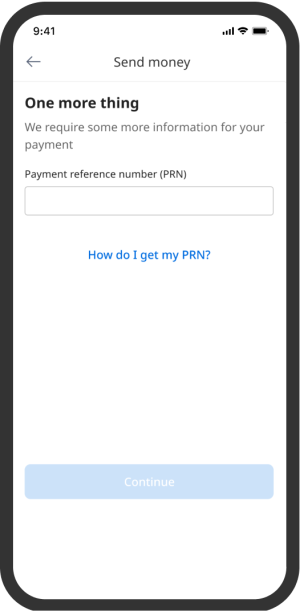

3. Enter your Payment Reference Number (PRN)

If you don’t have this on hand or aren’t sure where to find this, you can click ‘How do I get my PRN?’. This will direct you to more information on how to find your PRN.

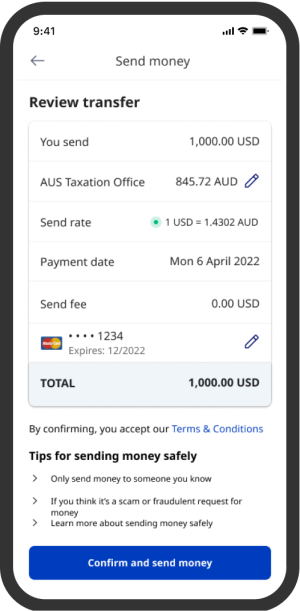

4. Enter your payment information and confirm.

Enter your payment information and confirm your money transfer.

On the confirmation screen, you'll see the full details of your transfer, including:

The amount of your currency you're providing

The amount of AUD that will be sent to the ATO

The exchange rate for your transfer

Any fees that you'll need to pay for your transfer

The date on which your payment will be sent.

You will be given an estimated completion date before you confirm your transfer. Please ensure you allow up to 4 business days (prior to your payment due date) for payments to reach the ATO and appear on your account. If a late payment occurs, you are responsible for any fees or penalty interest that may be applied.

Why use the Xe app for your overseas tax payments?

There are a few reasons why we’re one of just two recommended payment methods.

We make it easy for you. We already have the Australian Taxation Office’s information saved in our system. You won’t need to worry about whether you’ve sent your money to the right place, or whether it will get lost along the way. You’re just a few clicks away from making your tax payments, and you can do it from your mobile phone.

You can be sure that the full amount will reach the ATO. We'll send your funds straight to the ATO, with no stops through any intermediary institutions. That means that you won't be surprised with any extra fees during the process. The amount you see on your confirmation screen is the amount that will go to the ATO, so you won't need to worry about less money arriving than anticipated.

You can rely on Xe. We’ve been in the currency business for almost 30 years, and you can trust that we’ll get your money to its recipient, when it needs to be there. If you’d like more information about our service, just ask one of the 45,000 verified Xe customers who’ve given us 4.5 stars on Trustpilot.

Our transfers are cost-effective. Our rates are competitive, and our transparent pricing will inform you of any fees before you confirm the transaction, so you’ll know exactly what you need to send. If that rate changes after you send your payment, no need to worry: your currency will have already been converted and your payment sent.

Want to learn more?

Are you interested in learning more about our money transfer services or about our partnership with the Australian Taxation Office? Get started here.