Conversor de moeda XE

Bem-vindo à ferramenta de moedas e taxas de câmbio mais confiável do mundo.

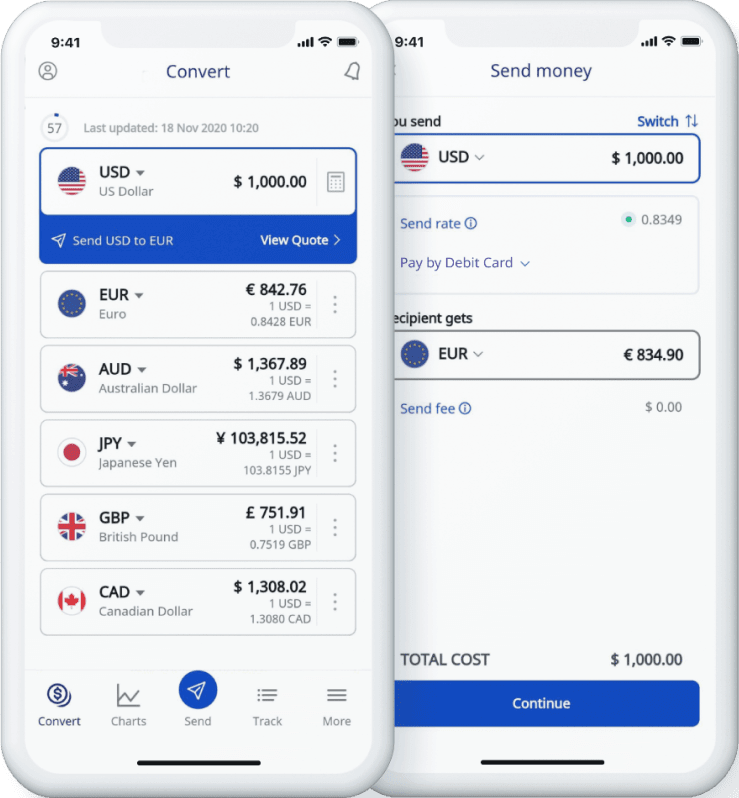

Taxas de câmbio XE em tempo real

As ferramentas de conversão de moedas mais usadas no mundo inteiro

Transferência internacional de dinheiro Xe

Envie dinheiro de forma rápida, segura e fácil via internet. Rastreamento ao vivo com notificações + entrega flexível e opções de pagamento.

Gráficos da Xe Currency

Crie um gráfico de dois câmbios mundiais para ver o histórico. Esses gráficos em tempo real usam taxas do mercado de médio porte, são fáceis de usar e são muito confiáveis.

Alertas de taxas Xe

Precisa saber quando uma moeda atingir uma determinada taxa? Os Alertas de taxa Xe informarão quando a taxa que você deseja for atingida entre as moedas selecionadas.

Ferramentas de moeda da XE

Recomendado por mais de 40 mil clientes certificados

, ratings

, ratings

, ratings

Notícias do mercado enviadas diariamente direto para a sua inbox

registrar-sePerfis de moeda

The Original Currency Exchange Rates Calculator

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe, our latest money transfer services, and how we became known as the world's currency data authority.