Conversor de divisas XE

Le damos la bienvenida a la herramienta de divisas más fiable del mundo.

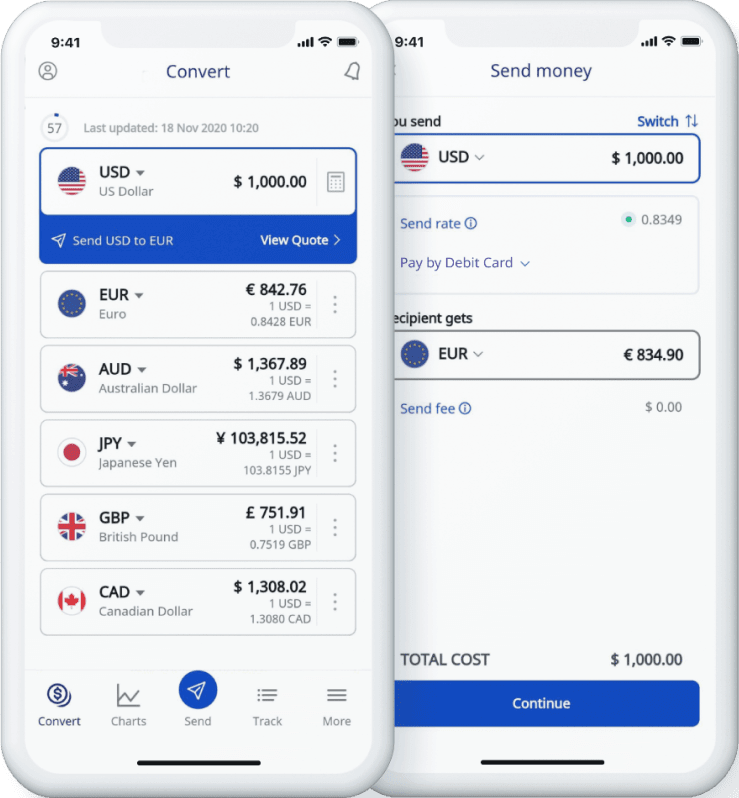

Tipos de cambio XE en tiempo real

Las herramientas de divisas más populares del mundo

Transferencias de dinero internacionales Xe

Envíe dinero en línea de forma rápida, segura y fácil. Ofrecemos seguimiento y notificaciones en tiempo real, además de opciones flexibles de entrega y pago.

Gráficos de Xe Currency

Cree un gráfico para cualquier pareja de divisas del mundo para ver su historial de divisa. Estos gráficos de divisas utilizan tarifas de mercado medio en tiempo real, son fáciles de usar y muy fiables.

Alertas de tipos XE

¿Necesita saber cuándo una moneda alcanza una tarifa específica? Las alertas de tarifas de Xe le permitirán saber cuándo la tarifa que necesita se encuentra disponible en los pares de divisas seleccionados.

API de XE Currency Data ►

Apoyamos tarifas a nivel comercial en más de 300 compañías en todo el mundo

Más información...Herramientas de XE Currency

Más de 40.000 clientes verificados recomiendan Xe

, ratings

, ratings

, ratings

Reciba actualizaciones diarias del mercado directamente en su correo

regístresePerfiles de la divisa

The Original Currency Exchange Rates Calculator

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe, our latest money transfer services, and how we became known as the world's currency data authority.